Credit cards are said to be helpful in several facets of our lives. But are they actually helpful and can you live without one?

When credit cards came into existence, it was sort of seen as a status symbol and was perceived to be something that only rich people could possess. The concept of swiping the card today to buy something and to pay the bill later sounded too good to be true. But it was true and many people, especially youngsters, took advantage of it. Statista says, as of August 2020, nearly 58 million credit cards were in use in India, and the numbers continue to grow despite the pandemic.

Apart from subscribing for more credit cards, people are spending more as well. Data from the Reserve Bank of India, as mentioned by Business Standard, said that Indians’ credit card spends in September 2021 rose 57% on a year-on-year basis to 80,000 crore. In a report, Motilal Oswal said, as mentioned by BS, from May to September 2021, the average monthly spending on a credit card increased to around ₹12,400 from ₹10,700 earlier. This shows how more people are relying on credit cards for their expenditures.

However, some spend lavishly and end up piling a lot of credit card debt. Then, they work towards paying off their debt. Hence, it is crucial to think whether you actually need a credit card or can you live your entire life without ever having one?

Building Credit

Credit cards are a useful tool to build credit. Since credit cards offer you the flexibility to pay your full balance each month or just pay the minimum, they are a pretty good indicator of how well you manage your credit. If you pay all your credit card bills on time and do not max out your credit limit, credit cards can help you build a strong credit history.

But that doesn’t mean you absolutely need one to build your *credit score. Credit scores are important in getting house loans. However, if you are unable to pay bills on time or carry a balance on your credit card, they can negatively affect your credit score. Also, if you cancel your credit card after paying off your debt, that will affect your credit score as well.

(*We have written a detailed blog about credit scores and how they work. Please read it to get a complete understanding of credit scores)

Getting Rewards

Credit cards give rewards, usually as cashback, cash bonuses, airline miles, which you can use to pay for travel, and points, which you can use for purchases. A lot of credit cards give you rewards when you sign up and they also offer interest-free payments.

But you can also shop online or make big purchases using a debit card as well. These days, online platforms offer discounts regardless of which payment mode you choose. So, make sure that you don’t start spending too much on your credit card after being tempted by the offers and rewards given at the stores.

Emergencies

When you face any unexpected situation, credit cards can definitely help you out. If you don’t have enough money in your savings account or if you don’t have access to it, credit cards can come and rescue you in those situations.

But that doesn’t mean you should rely only on your credit card for emergencies. You should start building an emergency fund from your first salary as it can help you during emergencies. Let’s say you use your credit card for an emergency, and your bills get due before your salary arrives, then you will be in a sticky situation. If you delay your payments, your dues will attract more interest and also, negatively affect your credit score.

Don’t Get It If…

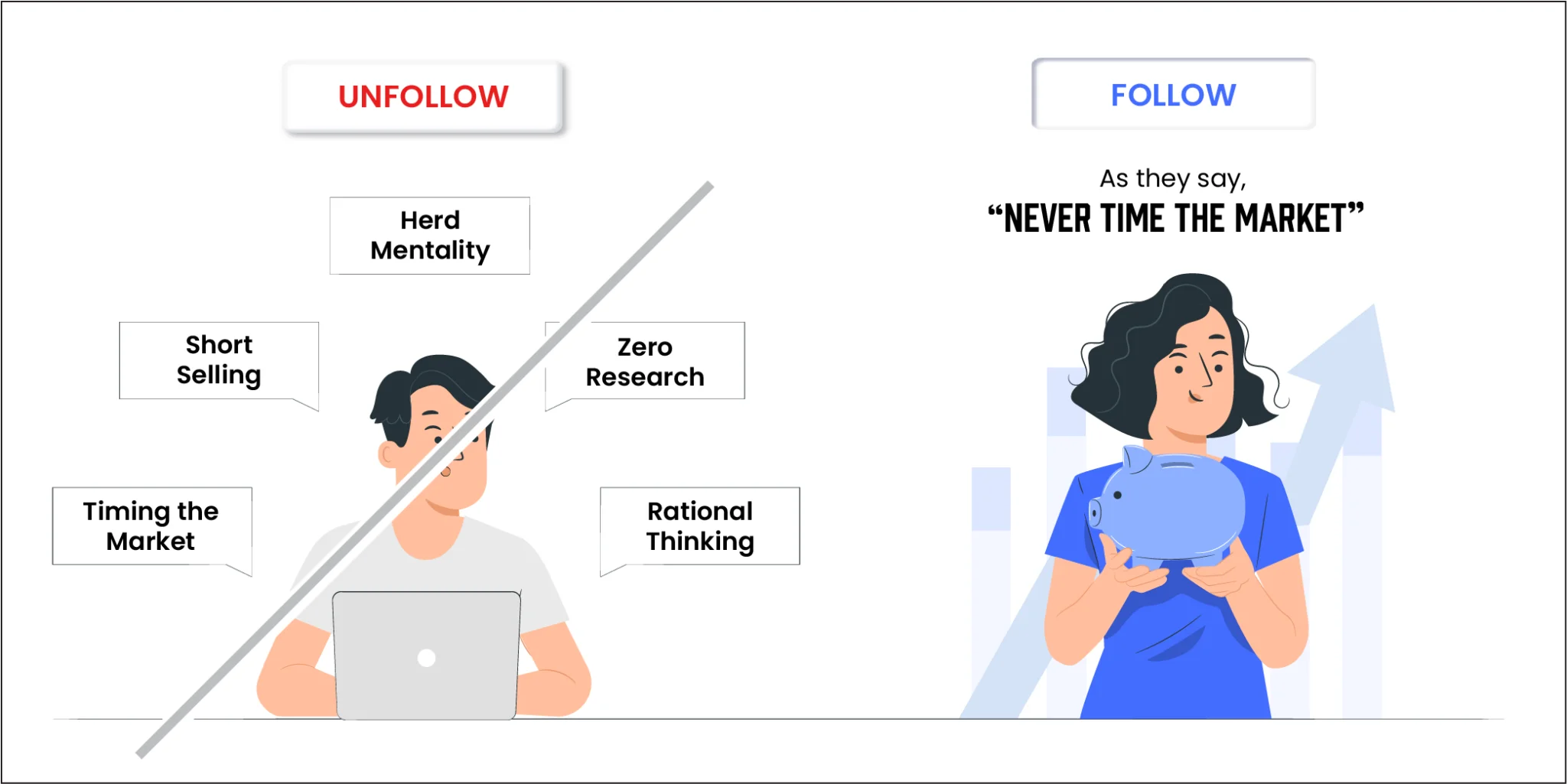

We have explained how credit cards can come in handy in times and how you can avoid falling into a debt trap. But we are going to explain the times when you should never get a credit card. If you are in these kinds of situations now or if you ever face these situations in the future, please never get a credit card.

- Spending Problem – You should completely stay away from credit cards if you have a spending problem. If you are someone who always spends above your means, and if you can’t afford to repay, then there is a high chance you will fall into a costly credit card debt.

- Jobless Situation – When you apply for a credit card, card issuers would consider your income while deciding whether or not to approve your card. If you are unemployed or if you have a reduced income and apply for a credit card, you may be denied. When your application gets denied, it will likely lead to a decline in your credit card score.

- Plan For Other Loans – If you have a plan to apply for a car or home loan in the future, then you should probably hold off on applying for a new credit card. Since your credit score gets affected every time a lender does a hard inquiry, avoid applying for a new credit card and other loans at the same time.

In The End…

Credit cards are a good way to build your credit, considering you have control over your spending habits. But do not get a credit card just because everyone else has one and end up not being able to pay your bills on time. In this way, you would ruin your credit score and rack up a lot of debt. So, a little bit of planning will help you control your spending and prevent you from making bad financial decisions.

Also, as we have mentioned before, you can read our blog about credit scores to get an understanding of how they work and how you can improve them. sign up koshex

Leave a Comment