New to trading stocks? We have compiled another list to help you navigate through the world of stocks.

In our last blog, we talked about some of the most important things that newbie stock traders should compulsorily know. Today, we will continue to talk about the same because the list is endless. We hope this helps you understand the pitfalls and how you can be extra careful when it comes to trading.

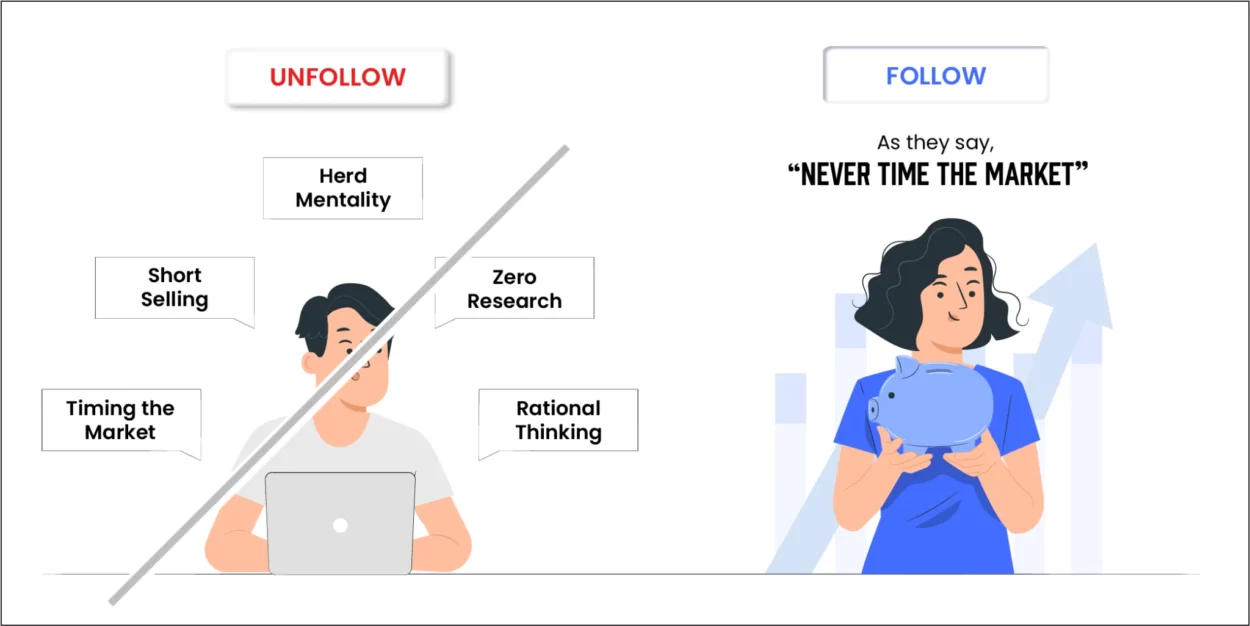

Following The Herd Blindly

The stock market is influenced by emotions. Most of the time, new traders follow the tips given by their acquaintances, neighbors or relatives and invest in stocks blindly without doing any research. This strategy has a high possibility of backfiring in the long run if you don’t do careful analysis. Herd mentality can backfire if you are not being cautious. Before you invest in any company, you should know about its business and understand everything about it.

No Short-Selling

If you are new to stock trading, it is better not to short sell, at least in the initial few days. But what is short selling? It is the selling of a stock that the seller doesn’t own. When you short sell a stock, your broker will lend the stock to you. The stock will come from the brokerage’s own inventory, or from another one of the firm’s customers, or from another brokerage firm. The shares are sold and the proceeds are credited to your account.

Sooner or later you must “close” the short by buying back the same number of shares (called “covering”) and returning them to your broker. If the price declines, you can buy back the stock at a lower price and make a profit on the difference. If the price of the stock increases, you have to buy it back at a higher price, and you will lose money. Even though short-selling allows you to take advantage of a falling market, you should avoid using it when you are still new.

Never Time The Market

Experts have always suggested everyone to avoid timing the market. Trust us, no one in this entire world has been able to successfully and consistently time the market by catching the tops and bottoms over several businesses or stock market cycles. In order to take advantage of the stock market, it is better to put money in the right shares systematically over the long term. It is important to have patience and follow a disciplined investment approach instead of timing the market and making irrational decisions.

Don’t Enter The Derivatives Market

Another one of the valuable tips for stock traders, who are beginners, is to avoid trading stock derivatives. The derivatives market is mostly made up of futures and options. These are contract-based purchases which have a fixed expiry date.

For example, you can buy a futures contract of SBI with only a margin of around ₹2 lakhs at the current price of ₹510. One futures contract of SBI consists of 3000 shares. Meanwhile, buying 3000 SBI shares at the current price of ₹510 will cost you over ₹15 lakhs. Professional traders regularly trade derivatives, but they are not advisable for beginners.

Try To Be Rational

Earlier, we mentioned how the stock market is influenced by emotions. The reason behind that is that emotions are what drives human beings most of the time. Acting on emotions is easier while making rational decisions takes time and patience. So, it doesn’t come as a surprise when we see how the market sees wild swings because of some rumors on the news.

So, it is important that you don’t do trading based as it might lead you to suffer heavy losses. Also, in a bear market, control your fear and don’t panic sell your shares at rock-bottom prices. Fear and greed are the worst emotions to feel when investing, so it is important to be careful.

In The End…

We hope this blog helps you understand what every stock trading newbie should know and what they should refrain from doing. The stock market is an amazing place to make good returns and we sell mutual funds on our platform, including Equity Mutual Funds, which invest in stocks. However, it is better to be careful and not go all in when you are new to trading stocks.

You might make a lot of money one day and you might lose more the other day, and that’s okay. The stock market is completely unpredictable, so try not to fall for scams, which say that a particular stock will give you 500% returns. Choose the stocks carefully and be patient. When you are a beginner, it is better to focus on long-term benefits rather than on short-term gains.

Leave a Comment