One of the most important aspects in investing, diversification helps your portfolio generate good returns and minimize risk.

Avoiding Losses At Any Cost

We, human beings, have many biases, and one of them is called Loss Aversion. You might wonder what this has to do with diversification? Let us explain. Loss aversion is a cognitive bias, which says that individuals feel the pain of loss twice as intensely than the equivalent pleasure of gain. This means, the unhappiness of losing ₹100 is greater than the happiness of finding ₹100.

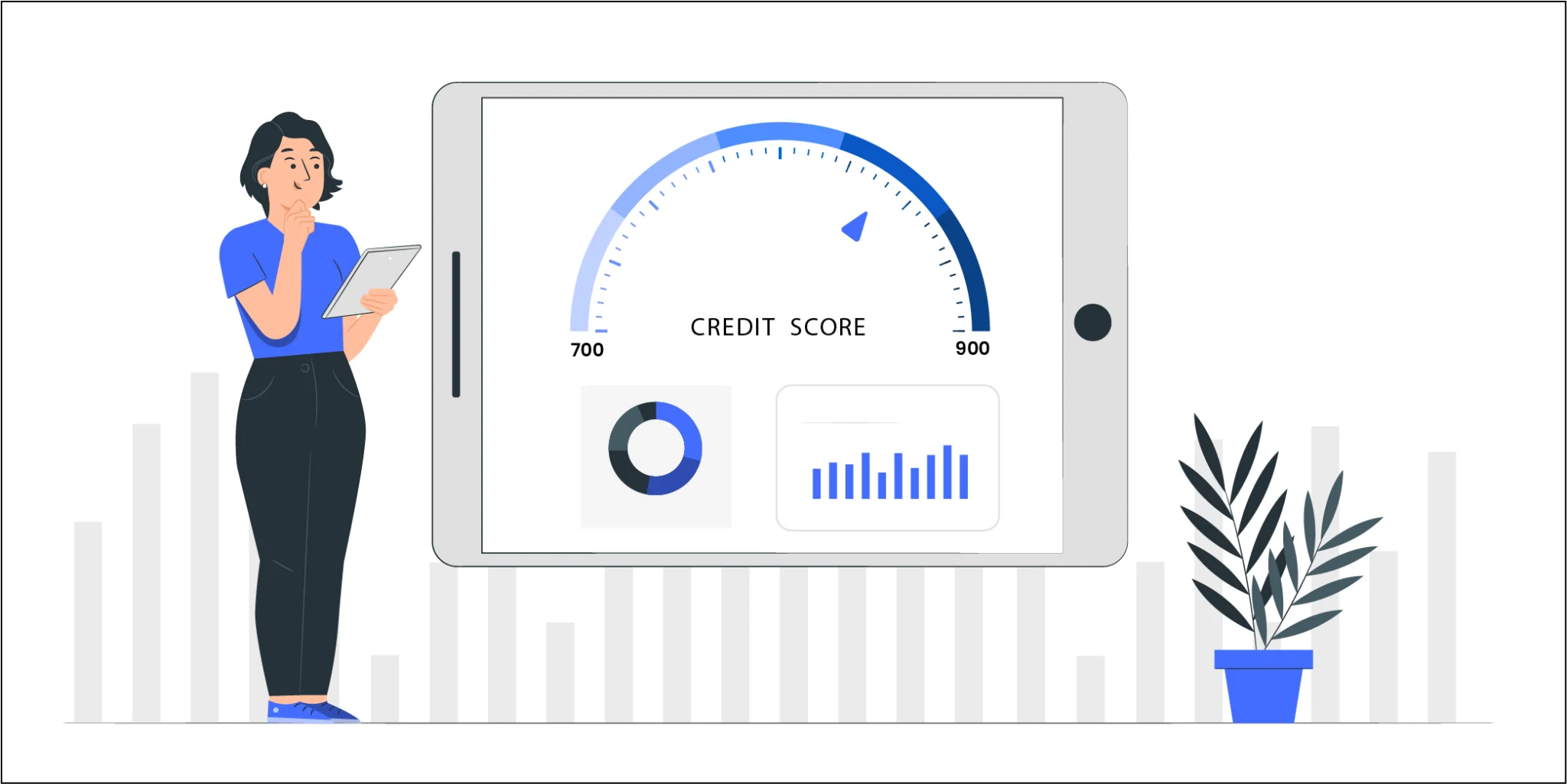

Loss aversion can considerably affect our decisions and lead to bad decision-making. It is true that we don’t want to incur losses. But the fear of incurring losses can prevent us from taking well-calculated risks, which can potentially give us good returns. Hence, if you want to reduce your loss in financial investments, you would have to diversify your portfolio, so that you can save yourself from the psychological trauma when you incur losses.

Diversification

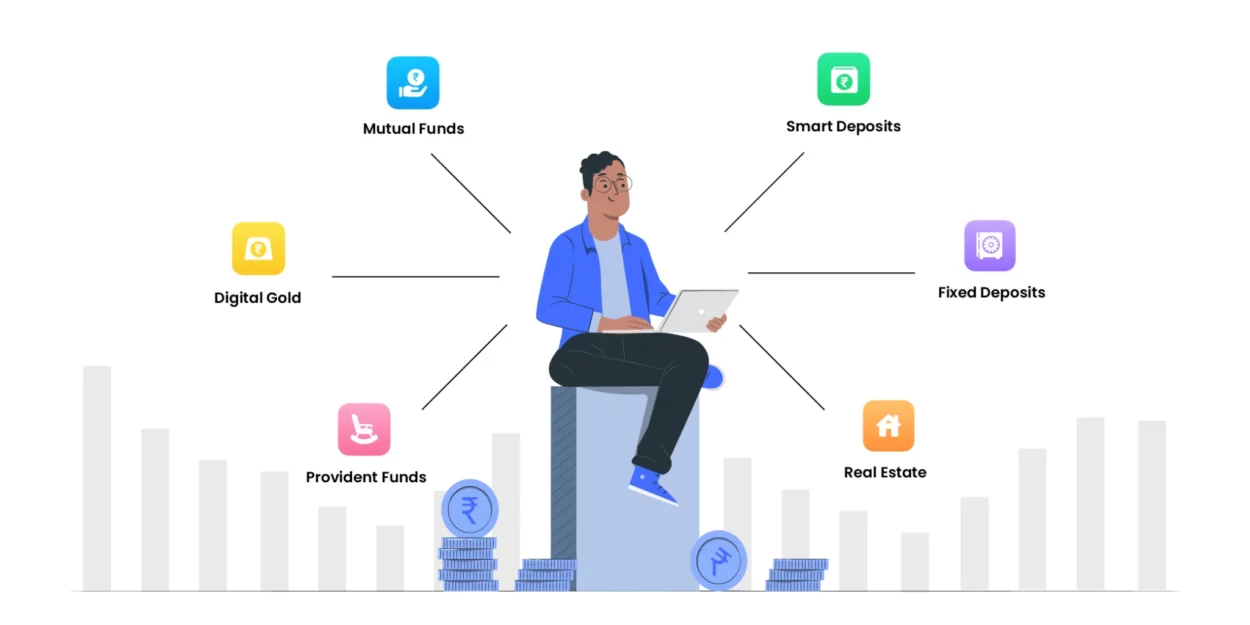

Instead of putting all your money in a single company, you diversify it across several industries, sectors or asset classes. This process is called Diversification or Asset Allocation. In India, investors can diversify between traditional asset classes of equity, fixed income and gold. Mutual funds also offer a convenient platform to construct diversified equity and fixed income platforms.

But why do you need to do it? Because diversification reduces overall risk and increases the potential for overall return. But how? When you invest in different instruments, some will perform well while others might do poorly. Hence, a well-diversified portfolio tends to earn higher returns as the losses made by certain instruments will be erased by the gains made by the other ones.

Diversification Strategies

If you have decided to diversify your investment portfolio, you can start with some simple steps. All you have to do is understand your investment horizon (i.e.) how long are you planning to stay invested? And your risk appetite (i.e.) how much risk are you willing to take? Once you have decided these, you will be able to choose the right financial instruments accordingly.

Equity & Debt

They are two of the most popular asset classes. Stocks and mutual funds offer the greatest potential for growth but they are also volatile. Debt Mutual Funds and bonds come with less risk, and they are also less volatile, but they offer less returns.

High risk equals high reward and vice versa. That’s why it’s important to understand your risk appetite. For young investors, it is generally recommended to allocate a large portion of their portfolio in stocks because of their long-term outperformance compared to debt mutual funds. At the same time, it is better to put some portion of your salary in debt mutual funds or bonds or recurring deposits, so that your portfolio is liquid and secured.

Industries & Sectors

Stocks can be classified by industry or sector. Meanwhile, there are also sectoral mutual funds, which offer the benefits of investing in various sectors of the stock market. It is important to put your money in different sectors or sectoral funds to make returns even during unexpected downturns in the stock market. When the COVID-19 pandemic ravaged the global stock markets, the pharmaceutical sector didn’t experience the same level of loss. Diversification by industry is another important way of controlling your investment risks.

Large Cap & Small Cap

Generally speaking, small-cap stocks have higher risks and offer higher returns than more stable, large-cap companies. In the past year, small-cap funds on average have delivered 62% returns and mid-caps have given an average of 42% returns, according to a report by Edelweiss Mutual Funds, as mentioned by Fortune India.

When you are young, it is wise to put a major portion of what you reserve to put in risky assets in small-cap funds. For example, if you are drawing a salary of ₹45,000 and have decided to invest ₹10,000 in mutual funds. If you have a high-risk appetite, then you should be allocating ₹6,000 to a small cap fund.

Building A Diversified Portfolio

If you are new to investing, you can start by putting a little bit of your money in a bank savings account and slowly venture into mutual funds. Large-cap mutual funds and mid-cap equity mutual funds are good option for newbie investors since they come with moderate risk and offer good returns. With mutual funds, your portfolio is already diversified as one scheme will invest in different stocks across different industries.

If you have a high-risk appetite, you can invest in small-cap equity funds, Stocks, and ETFs. You can also consider investing in Digital Gold, and Smart Deposits to reduce your overall risk and bring liquidity to your portfolio. Diversification is all about picking and choosing what’s right for you. But is there any way this process could be made even easier? YES!

Koshex, a new-age wealth management platform, customizes a portfolio for you that suits your financial goals and risk profile. Create an account today, and let the AI create a personalized investment solution for you. Then, you can invest in products, including Mutual Funds, Smart Deposits, and Digital Gold. With Koshex, you can also find your net worth and track the progress of your financial journey. It doesn’t get easier than this. Head to Koshex today!

Leave a Comment