Got a bonus? Made big returns from selling stocks for a profit? Then, the lumpsum mode is here to make your financial life even better.

In our last blog, we explained about Systematic Investment Plan (SIP) and how it can help you with your financial journey. In this one, we will be explaining about the Lumpsum mode. This blog comes with the Koshex promise as well – No jargon and everything will be explained in an easy-to-understand manner with examples.

What Is Lumpsum?

When you invest in a mutual fund scheme via the lumpsum mode, it means a single, bulk amount is locked into a one-time mutual fund investment. The lumpsum mode is usually preferred by large companies and also, those investors, who particularly depend on company stock appreciation for capital creation. But that doesn’t mean retail investors like you should stay away from it. Investors who have a sizable investment amount and a high-risk appetite can choose the lumpsum mode as it can be a good investment opportunity.

Let’s say, you received a large bonus this year. After keeping aside money for your pre planned commitments, you decide to invest the rest. Then, the lumpsum mode would be the right choice for you. But how can you make the best returns out of your lumpsum investment? Read on…

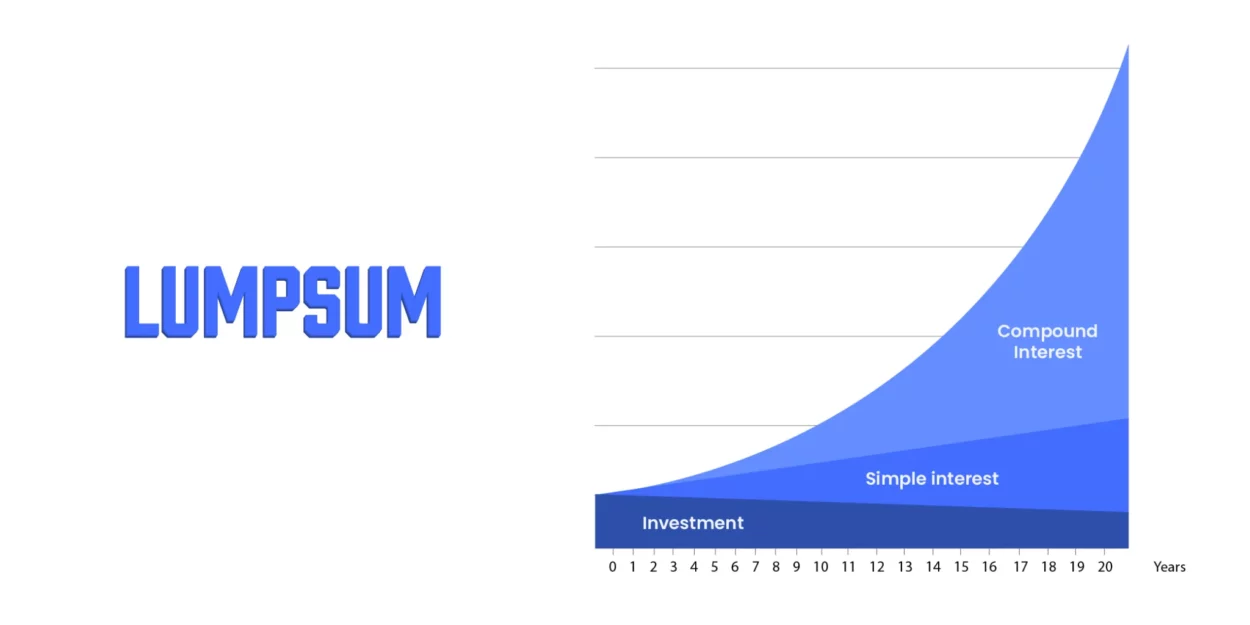

Staying invested for a long period

Lumpsum investments are suitable for those investors who are in it for the long-term, preferably 10 years or more. If you invest in equity funds via the lumpsum mode, it is better to stay invested for the long-term, as stock markets tend to be volatile.

If they are held for a long period, the probability of losses gets reduced and the chances of earning higher returns go up. So, if you stay invested for the long-term, it is better for you. But, if you are looking to stay invested only for a short period, then make STP your best friend.

Making STP Your Best Friend

When you invest in debt mutual funds via lumpsum, it can provide you liquidity in the form of Systematic Transfer Plans (STP). But what is an STP? It is a plan where investors can periodically switch or redeem a certain amount or units from one scheme and invest in another scheme of the same mutual fund house.

For example, if you invest ₹1 lakh in an equity fund via an STP, as the first step, you will have to select a debt fund which allows STP to invest in that particular equity fund. Once you select, you should invest the entire amount in the debt fund. Later, you will have the option of transferring the money from debt to equity funds of the same fund house and you can also choose the suitable frequency. In this way, you can reduce the risk of equities by spreading the investment over a few months instead of investing the entire amount at one point.

Invest when it’s down

Let’s be honest here. You can never time the market and even if you invest when the market is down, it is unlikely to predict whether the market will continue to trade lower or go up in the future. Usually, lumpsum investments are advised to be made when the market sectors are in a down cycle but are showing growth potentials.

For example, the stock market tends to decline ahead of the Union Budget. The days before the 2022 budget, the indices fell nearly 7% in seven sessions. Sometimes, the market tends to go through a correction period even after the Budget. In these kinds of situations, you will be able to earn higher returns via the lumpsum mode than the SIP mode. However, if you invest a bulk amount when the markets are up, you might end up with a loss.

Bottomline

With the lumpsum mode, you have better control over your investments and earn better returns than investing in an SIP. This mode also gives you the power to benefit from market corrections. The best way to diversify your investments is by putting some money via SIP and some through lumpsum so that you can make returns even during market downsides and it will help you minimize the losses.

Convinced about investing in mutual funds through lumpsum? Head over to Koshex and choose your favorite mutual fund scheme from over 10,000 schemes across 40+ mutual funds. Tell us your favorite mode of investment in the comments below!

Leave a Comment