You don’t have to make life-altering financial decisions in a single day. You can start with small changes today and it will transform your life for the better tomorrow.

We have written several blogs about forming new financial habits that could help you achieve your life goals. But, we get it. It is not easy to break your old habits and form entirely new ones in a couple of days. They say it takes 21 days to form a habit. We all know the pain of sticking to a habit for one week, let alone 21 days. When the new year comes, we push ourselves to form new habits but we find it difficult to stick to them after some time.

If that’s the case with habits such as working out, going to the gym, cutting down on sugar, then we can imagine the difficulty in keeping up with new financial habits like tracking expenses, following a budget and automating your savings. In this blog, we will be discussing small changes that you can make in your daily lifestyle to help you save money and reach your goals.

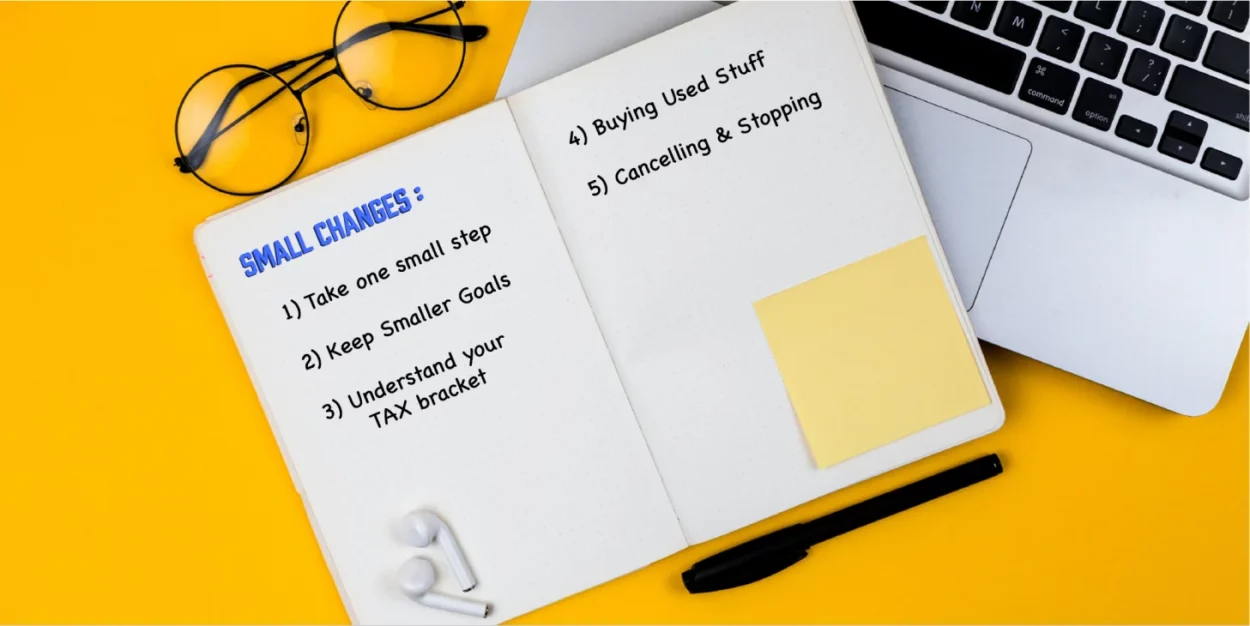

Take One Small Step

The world of finance can get complicated and overwhelming at times. There are so many financial products and new ones are coming to the market every now and then. So much information is being flooded in social media platforms through influencers. Emergency fund, retirement fund, insurance cover, wealth creation – so many buzzing words and it is alright to feel confused.

Just remember that you can start small and make your way up. You can start with allocating a little portion of your salary every month. This money will come in handy when you have unexpected expenses. In the beginning, you can save this money in a bank savings account. This might be a small step, but starting small is better than procrastinating and delaying your financial journey.

Keep Smaller Goals

This is in line with the first suggestion. Sometimes, when the new year comes around, we tend to make resolutions such as going for our dream vacation or buying a luxury car. Since these goals are vague, we tend to get anxious when we fail to achieve them. Hence, it is okay to set the bar low in the beginning. If you are new to making your own financial decisions, start low and slow.

You can tell yourself that you will save 5% of your salary every month. Since saving 5% is not a big amount, you would be able to do it even during those months, which have unexpected expenses. The more months you save 5% of your salary, the more confidence you will gain to set bigger goals.

Understand Your Tax Bracket

You might not be paying any taxes at the moment because your yearly salary might be less than ₹5 lakhs. However, it is important to learn about your tax bracket and how income tax works. It will help prepare you properly in case you need to pay income tax in the future. It will also help you understand how you can pay less taxes.

Learning basic things such as paying taxes and filing tax returns will reduce your anxiety during tax season. When you know the concepts, you wouldn’t have to rely on anyone else and choose tax-saving products on your own.

Buying Used Stuff

Buying used books, clothes, furniture, vehicles and more can save thousands of rupees every year. If you are someone who loves shopping for new clothes every season, you can take a look at shops that sell used clothes. This is also the most sustainable way to live since you are giving a second chance to these used objects. You can join Facebook groups to find people who are selling used things and are ready to swap things.

Canceling & Stopping

The most important financial habit to develop in your life is tracking your spending. But why? When you begin tracking your expenses, you will be able to understand where each and every penny is going. You might find out that you are spending money on a streaming service that you don’t use or on a food app subscription that you rarely use since you mostly cook at home or hardly go out.

These payments might be deducted from your bank account automatically, and if you don’t pay attention to them, you will continue to lose more every month. So, at the end of every month, do a thorough analysis of your spending to detect these unnecessary expenses.

In The End…

Getting good with money and building a good financial life takes time. Not everyone was born with all the necessary knowledge. The important thing is taking small steps so that you can eventually achieve your goals and fulfill all your dreams. If you are looking for a platform to track your progress, you can create an account with Koshex, as it offers intelligent insights about your finances so that you can make better financial decisions.

Leave a Comment