You might have picked stock trading as a hobby and might be making good money out of it. But here are the most important things you should know about trading in stocks.

A report by the State Bank of India, as mentioned by TOI, showed that a massive 142 lakh new individual investors joined the stock markets in the pandemic-affected financial year of 2020-21. This shows how retail investors are increasingly showing more and more interest in the stock market.

There could be a plethora of reasons why retail investors are rushing to the stock market; it could be because of the awareness created by AMFI or the fact that more Generation Z are coming into the workforce every year and looking for new investment instruments or it could simply be because people were bored during the lockdown.

Whatever your reason for getting into stock trading, you have to be aware of certain things as day trading is definitely for seasoned investors, who research stocks in detail, and keep up with the news to stay in the know. So, here is everything you need to know if you are new to trading stocks.

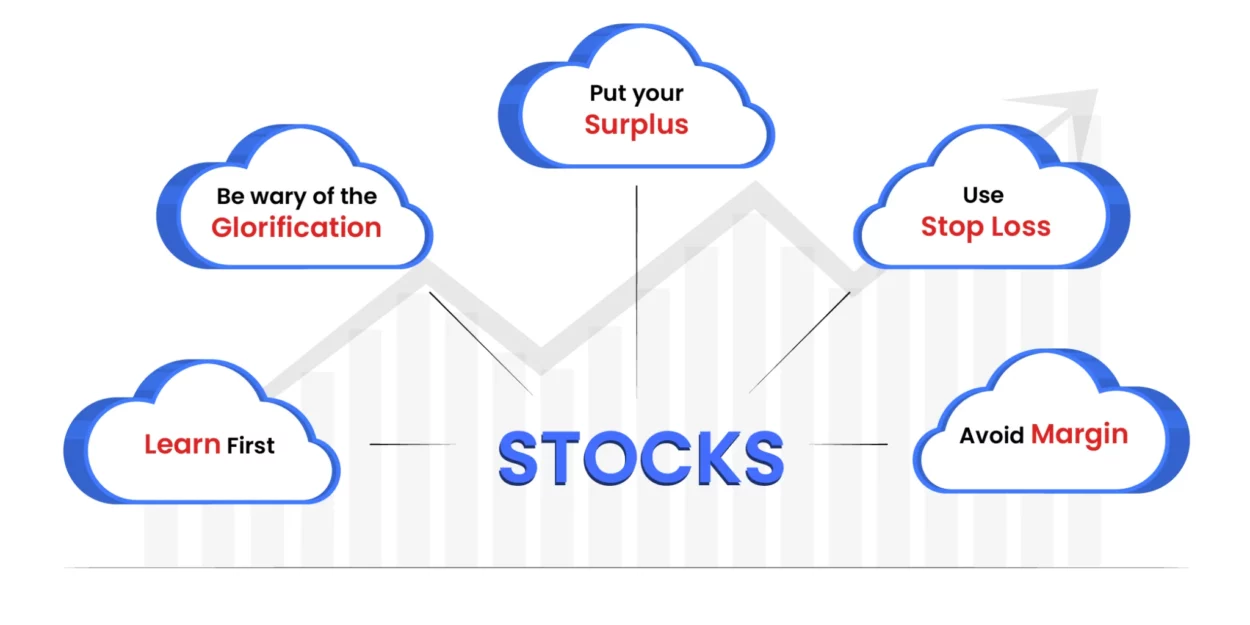

Learn First

Never jump into the stock market blindly without learning the basics. Your friends might be making money from buying stocks, and you might have entered the arena to do the same. However, if you enter the stock market without having any knowledge about how it works, there is a high possibility that you will lose a lot of money. You should only buy stocks after learning about them. You should also have a clear understanding of how adding stocks to your portfolio will help you achieve your financial goals.

Be Wary Of The Glorification

After watching ‘Wolf Of The Wall Street’, were you one of those people who thought that you could make millions of dollars in a couple of months by trading stocks? Then, let us tell you that you are very wrong. The stock market is not a money-making machine for everyone. Even though many people have made a lot of money from the stock market, many have lost a lot of money in it as well.

The ones, who have been making money from trading in stocks, are highly knowledgeable and they have been doing this for a long time. Try not to fall for gimmicks, where it says that you can make millions in a couple of days.

Put Your Surplus

A lot of newbie investors cannot afford to lose money. Hence, it is important that you invest only your surplus funds in buying stocks. You can use your bonus, cash gift, tax refund, etc. to buy stocks, as you won’t feel bad when you lose that money. Investments are done to generate revenue, so it is crucial that you don’t put your emergency fund in the stock market. Since you are a beginner, only put the amount of money that you can afford to lose.

Use Stop Loss

When you are a beginner, it is best to use stop loss on every trade. A stop-loss helps you reduce your loss as it allows you to select a price at which your position will be automatically squared off. For example, if you are purchasing 100 shares of Wipro, at ₹1000 each and expect its price to increase, you can put a stop loss at ₹1020. If the price of the shares falls, your 100 shares will be automatically squared off when it reaches ₹1020.

Avoid Margin

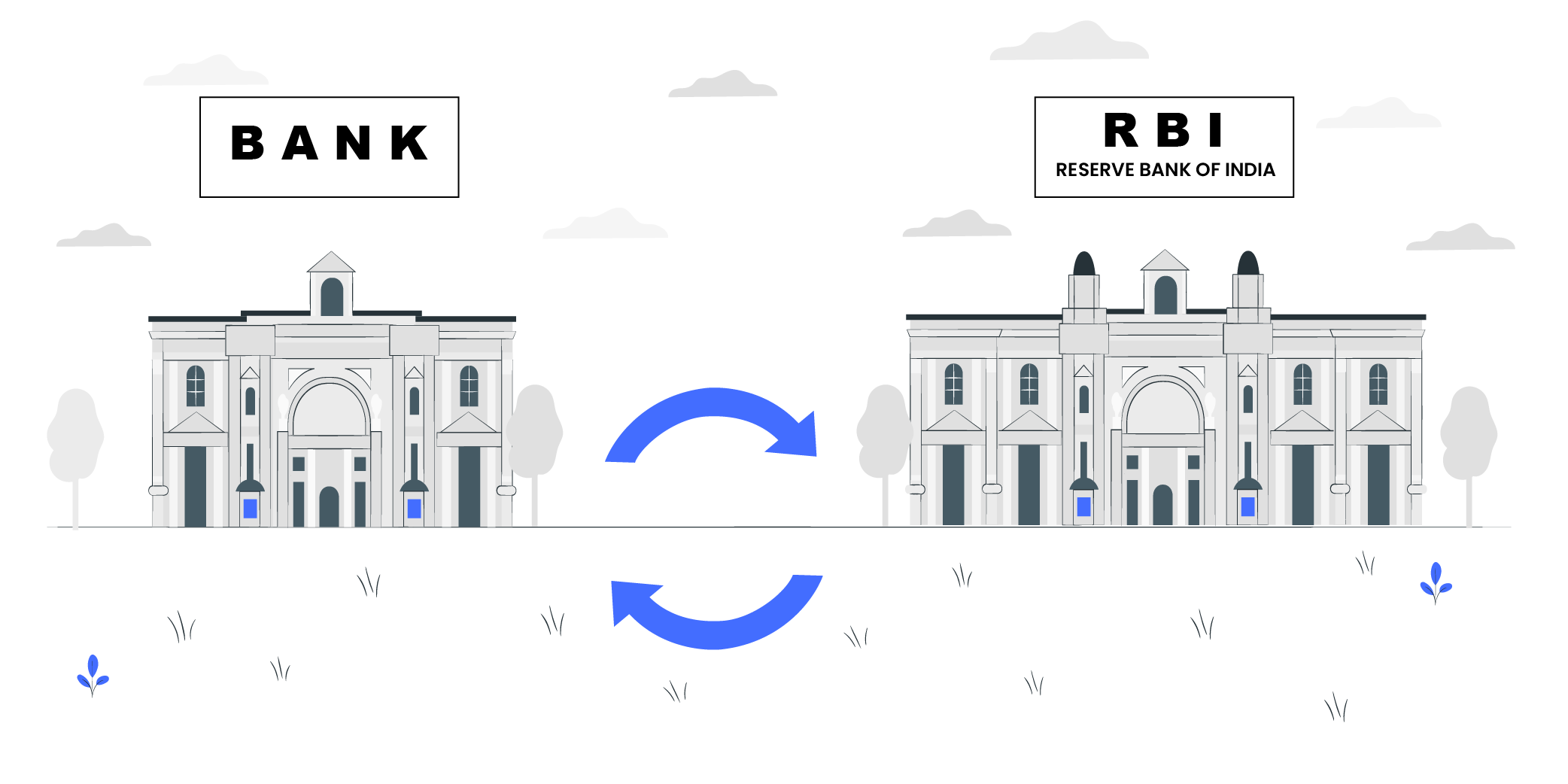

Apart from using your own money to buy stocks, you can use leverage as well. Leverage simply means using borrowed money to execute your stock market strategy. In a margin account, banks and brokerage companies lend you money to buy stocks. It is a good tool for experienced investors, but if you experience a loss, you will not only erode your initial investment, but you will also have to pay interest to the broker.

In The End…

Trading in stocks is not for everyone, so it is okay if you are not interested in buying and selling stocks and do not want to learn about the stock market. You do not need to follow every trend and you do not have to invest in every financial product to generate returns. If you are looking to include high-risk assets in your portfolio, you can choose to invest in Small Cap or Multi Cap Mutual Funds.

If you are looking for a platform to invest in Mutual Funds or create a diversified investment portfolio for yourself, you can head to Koshex. Our platform offers financial products, including Mutual Funds, Smart Deposits, and Digital Gold, and you can manage your finances better with our AI. Don’t wait, head over to Koshex today!

Leave a Comment