As more and more people adopt this movement, we are here to tell you what it is and how you can retire early using it.

Meet The FIRE Movement

The idea of the FIRE (Financial Independence, Retire Early) movement was initiated by Vicki Robin and Joe Dominguez in their 1992 best-selling book “Your Money or Your Life”, and seconded by Jacob Lund Fisker in his 2010 book “Early Retirement Extreme”. The movement, which is popular among the Western nations, has now reached India too. But what exactly is it?

Just like the name suggests, FIRE is all about retiring early by adopting extreme saving methods. People who join the FIRE movement want to retire early by being frugal, using extreme saving methods like setting aside half of their earnings and generating an income through passive investments. This movement is favored by those who want to quit their work, want to gain financial independence and move their retirement age forward.

How Do You Do It?

Retiring before 40 sounds appealing as it gives you so much time to fulfill all the items in your bucket list. Instead of waiting until you are 60 to go for the World Tour, you can do it when you are 40, thanks to FIRE. But is it easy? Absolutely not.

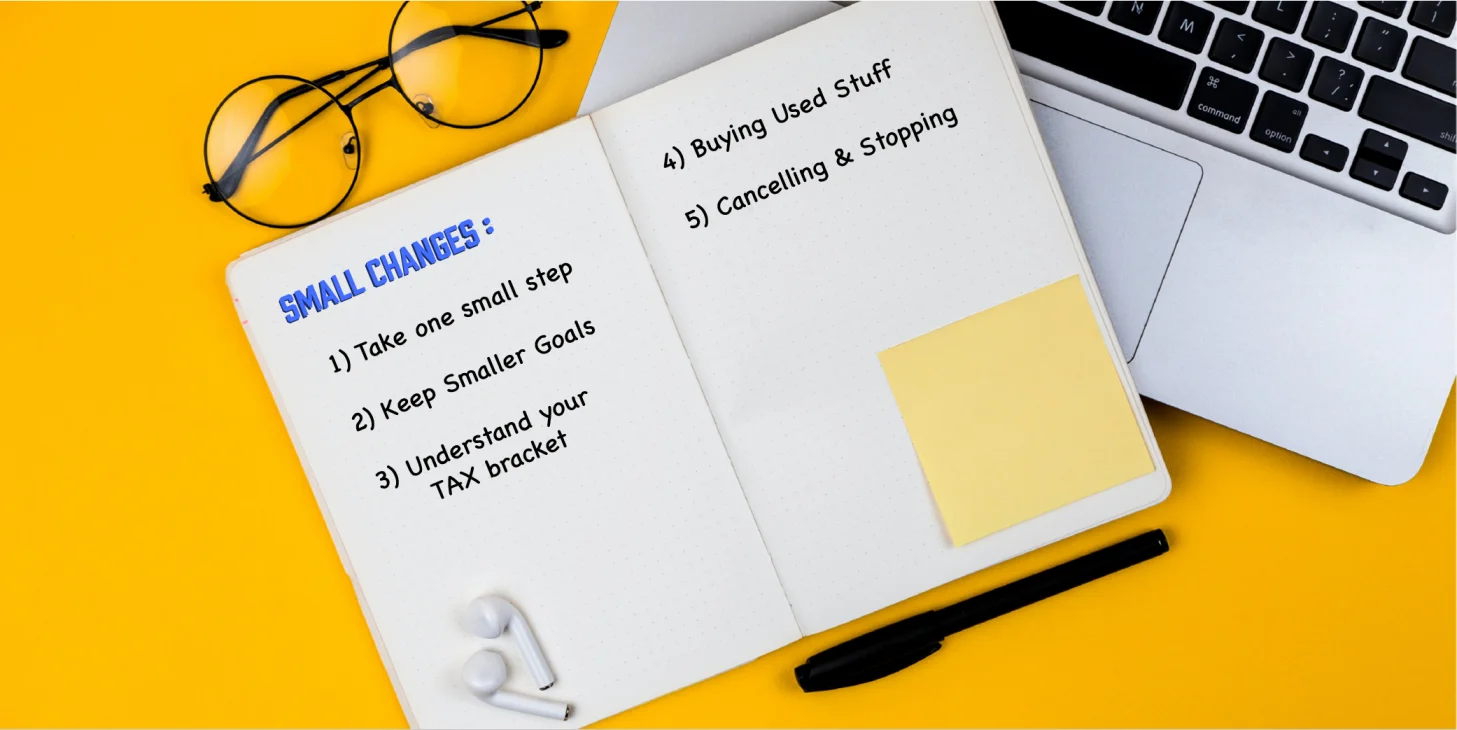

- The key part of FIRE is saving up to 70% of your monthly income

- Living an extremely frugal life

- Paying off all your debt, including your student loans, car loans and home loans

If you are not up for doing the above three things, then FIRE might not be for you. Saving most of your income and living frugally will help you build a sizable retirement corpus. It is extremely important to be prepared for unexpected situations like the pandemic so that you can rest easy knowing that these sudden incidents will not eat into your retirement fund.

So, what is the comfortable number here? How much do you actually need to save to retire early?

The magic number is building a net worth of 25 times your estimated annual expenses. For example, if your annual expenses are ₹5 lakhs, your retirement corpus should be ₹1.25 crore. Also, once you retire, you should withdraw only a maximum of 4% from your retirement fund each year.

The Types

There are different types of FIRE, which have developed throughout the years. We will be learning about them here.

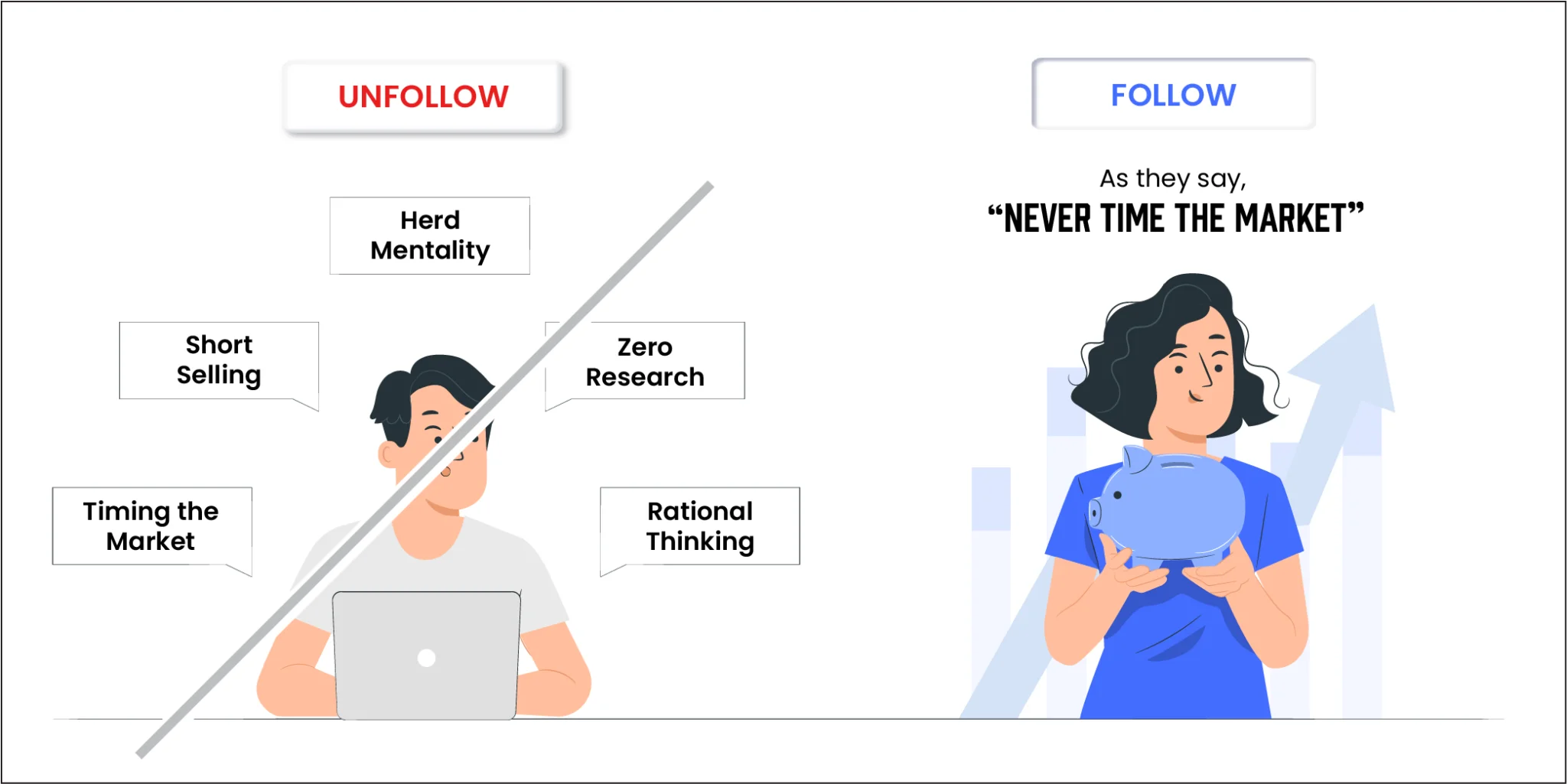

Lean FIRE – In this approach, people adopt a “lean” style of life to save sufficient funds to retire as soon as feasible. This approach emphasizes people to live on the minimal necessities and save the rest. Due to the severe savings and the lower retirement income, you would attain FIRE sooner. Many people who follow ‘Lean FIRE’ live on less than $25,000 a year.

Fat FIRE – This strategy emphasizes on not having to make as many sacrifices in the present spending or retirement. Hence, you will need to save more money to finance your lifestyle if you follow this method than the Lean FIRE method.

This strategy is suitable for those who have a traditional way of life but want to save a lot more money than the average person but don’t want to sacrifice their current standard of living. If you want to make the Fat FIRE method work, you would need a lot of money and put most of your funds in suitable investment instruments.

Barista FIRE – This method is about saving enough money to help you retire early from your primary employment. Instead of completely quitting from the workforce, people who follow this method may use their financial freedom to work part-time, freelance or pursue a less well-paid dream vocation. This will allow people to work for joy rather than survival.

Coast FIRE – People who follow this strategy want to invest as much as they can in their retirement accounts before 30. In this method, they hope to give their investments the advantage of time in the market. This approach might demand a conservative living and a high salary so that people who follow this method can invest the desired amount each month.

Why Choose FIRE?

Max Life Insurance’s India Retirement Index Study, as mentioned by The Economic Times, found that 80% of urban Indians are not ready for retirement. When the study looked at the barriers that are stopping people from planning for retirement, it found some interesting things: 45% of respondents said that their children will take care of them while 36% of respondents think there is enough family wealth. Meanwhile, 33% said that it is too early to think, 30% said there are more important things and 30% said they don’t need much money.

This study shows how most Indians are unprepared for retirement. So, the good thing about the FIRE movement is that it pushes people to think about their retirement plans. It pushes them to understand their current financial status and how much they would need to lead a comfortable retirement life. The pandemic has also shown the importance of preparing for unexpected situations.

Even if you are not looking to retire in the next 15 years, it is important to start budgeting today and save for your retirement from your first salary. It is never too early to start investing for your future. If you would like to know where you stand financially, create an account with Koshex. The new-age wealth management platform will help you manage your finances better, automate your savings, and offer intelligent insights to make informed financial decisions. Get started with Koshex today!

Leave a Comment