A recent survey says most millennials are stepping up their financial strategy for the future. How are they doing it and how can you step up your strategy?

Step It Up

CASHe, an AI-driven financial wellness platform, has released a survey ‘Millennial Mood Index 2021’ (as mentioned by APN News) and the findings are fascinating. The survey shows that more than 84% millennials across India have stepped up their wealth management strategy in order to prepare for future contingencies while also looking for opportunities for stronger and sustainable growth in a post-pandemic world.

But how exactly are they stepping up their strategy? 52% of the respondents said they have increased their savings while 35% said they have purchased comprehensive health and life insurance plans. Meanwhile, the remaining 13% said they have committed to more extensive investment programs. This shows how millennials are becoming more serious about their financial choices and also, understanding the importance of having a solid financial strategy for their future.

Why Should Millennials Step Up?

The answer might seem obvious and it is the same answer that has been plastered everywhere – It is the pandemic. India, the home to over 440 millennials, wasn’t exactly thriving on the jobs front even before the pandemic. Unemployment in India was at a 45-year high before the pandemic and several people, who had been working, lost their jobs when COVID-19 began to spread across the world. Before the pandemic, there weren’t enough job opportunities for India’s youth while the remaining jobs began to evaporate during the lockdowns.

While things began to become better after the horrible second wave, the Omicron variant came out of nowhere and surprised us. It wasn’t exactly a pleasant surprise. However, the World Health Organization (WHO) has said that Omicron will not be the last variant, and there will be more variants in the future. The head of WHO, Tedros Adhanom Ghebreyesus, said, as mentioned by Reuters, “…globally the conditions are ideal for more variants to emerge.”

So, the future will continue to be uncertain and it is affecting our financial and mental health. A July 2020 survey by Max Life Insurance and Kantar, a data and consulting company, as mentioned by Livemint, showed people in metros are more anxious than those in tier-I cities about job security, stable income, insufficient funds due to a case of a critical illness and rising day-to-day medical expenses. To better prepare for the future and safeguard our mental health, we should step up our financial strategy.

How To Step Up?

Educating Yourself

It is highly important to have basic financial education. We get it; looking at stock market graphs and reading about economic policies might be tiring. But we are not talking about that. Firstly, you should have an understanding about where you stand financially and then, know about financial products like mutual funds, bank deposits and how they work. You should also understand the importance of saving money, paying off debts and investing for your future.

There are a plethora of resources available online to help guide you. You can also read our blogs where we have broken down complicated concepts into simple articles. When you don’t educate yourself and solely depend on a financial advisor to take care of your finances, you might not be able to fully understand the performance of your portfolio and whether or not it is working towards helping you achieve your goals.

Creating A Budget & Sticking To It

Before you start thinking that you would need fancy bullet journals or apps to begin budgeting, let us assure you that creating a budget is easier than you think. Apart from that, it is important to create a budget as it will help you spend within the limit and avoid making unnecessary purchases. A budget will also hold you accountable every month and prevent you from going overboard with your money.

Automating Your Finances

When you put your financial plan on autopilot, it will help you achieve your goals seamlessly. Chris Reining, a self-made millionaire, crossed the $1 million threshold at age 35 and retired at 37. He told CNBC how putting finances on autopilot saves time and mental energy.

He added, “I automated my money years ago, and the benefit is I don’t have to make decisions about where my money should go, how much I should invest, what I can spend, do I have enough savings, and so on.” If you are looking for a platform that will automate your investing easily, head over to Koshex and get your financial life on track.

Setting Goals & Starting To Invest

There are several reasons to invest and those reasons are for:

- Building an emergency fund

- Saving for retirement

- Saving for reducing taxes

- Saving to achieve goals like buying a car, a house and so on

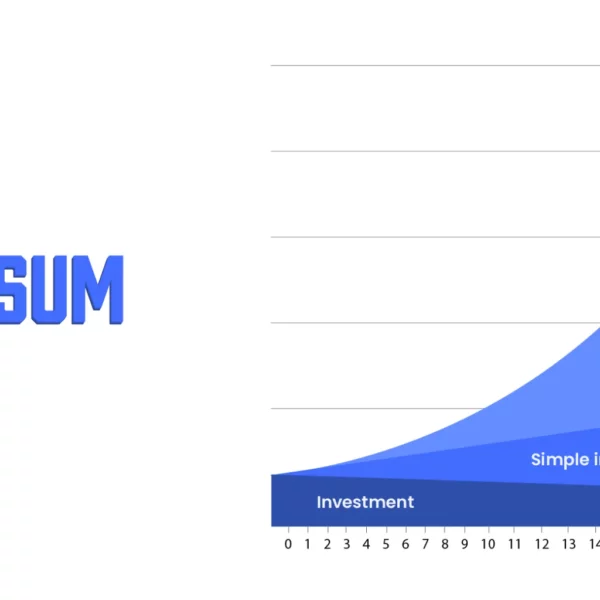

Setting short-term and long-term financial goals will help ensure that you can achieve them with ease. After setting the goals and plans, it is important to start investing in suitable financial products. Ramit Sethi, a personal finance expert writes in “I Will Teach You To Be Rich”, “On average, millionaires invest 20 percent of their household income each year. Their wealth isn’t measured by the amount they make each year, but by how they’ve saved and invested over time”, mentions CNBC. Hence, you should make sure to allocate at least 10-20% of your income towards investing in a financial product that is suitable for you.

Also, you should make sure that you are investing in several different financial products, so that you can create a diversified portfolio, which will help minimize losses and generate higher returns. Since all our financial goals are different, we should create a portfolio that is customized to our needs.

Please Note: We have written detailed articles on each of the topics mentioned above and we would like you to read them to get a better understanding of the concepts discussed here. They can be read within 3 minutes and if you liked this one, make sure to comment whether you have stepped up your wealth management strategy this year!

Leave a Comment