It is a sign of a responsible citizen to file an income tax returns (ITR) regularly and within the due date. An ITR filed by us helps in the development of the country. However, due to some unavoidable circumstances, we may not be able to file this within the timeframe.

The failure to file an ITR within the due date incurs a penalty fee as per the Indian Income Tax Act, 1961.

The last date for filing an ITR for the assessment year 2022–2023 was July 31, 2022. There are many consequences and inconveniences if you do not file your ITR within the due date and one of them is paying a penalty. Let us go into the details of the penalty for late filing of income tax returns and other consequences.

Penalty fees for filing an income tax return after the due date

According to Section 234F of the Indian Income Tax Act, 1961 and amended by the Finance Act, 2022, the penalty fee for not filing an income tax return within the due date is 5,000 rupees for income above Rs. 5 lakh.

However, if the income is less than Rs. 5 lakh, the penalty fee for filing an ITR after the due date is Rs. 1,000. These rules are applicable for the assessment years starting on or after April 1, 2018.

Time provided for filing revised return

Suppose you made a mistake while filing an ITR or you came to know that you omitted a statement while filing an ITR. Still, you will have a chance to file a revised return according to Section 139 (5) of the Indian Income Tax Act, 1961.

Earlier, the time provided for filing a revised return was two years. But now this window has been reduced considerably to three months before the end of the assessment year.

Therefore, the due date to file the belated/revised ITR for the assessment year 2022-2023 is December 31, 2022. This is why you should file an ITR as early as possible so that you will get a good amount of time to revise and rectify your mistakes.

Rules regarding payment of interest as per Section 234A

According to Section 234A of the Indian Income Tax Act, 1961 and amended by the Finance Act, 2022, if the ITR is filed after the due date or not filed at all, you are liable to pay interest at the rate of 1% of the tax amount for every month or the part of the month. This period begins immediately after the due date.

For instance, the due date for filing an ITR is July 31, 2022. You are filling an ITR on October 15, 2022. Then you need to pay interest at the rate of 1% of the tax amount for two and half months. So, your ITR amount will comprise the tax amount, penalty fees for filing an ITR after the due date, and 1% interest for two and half months.

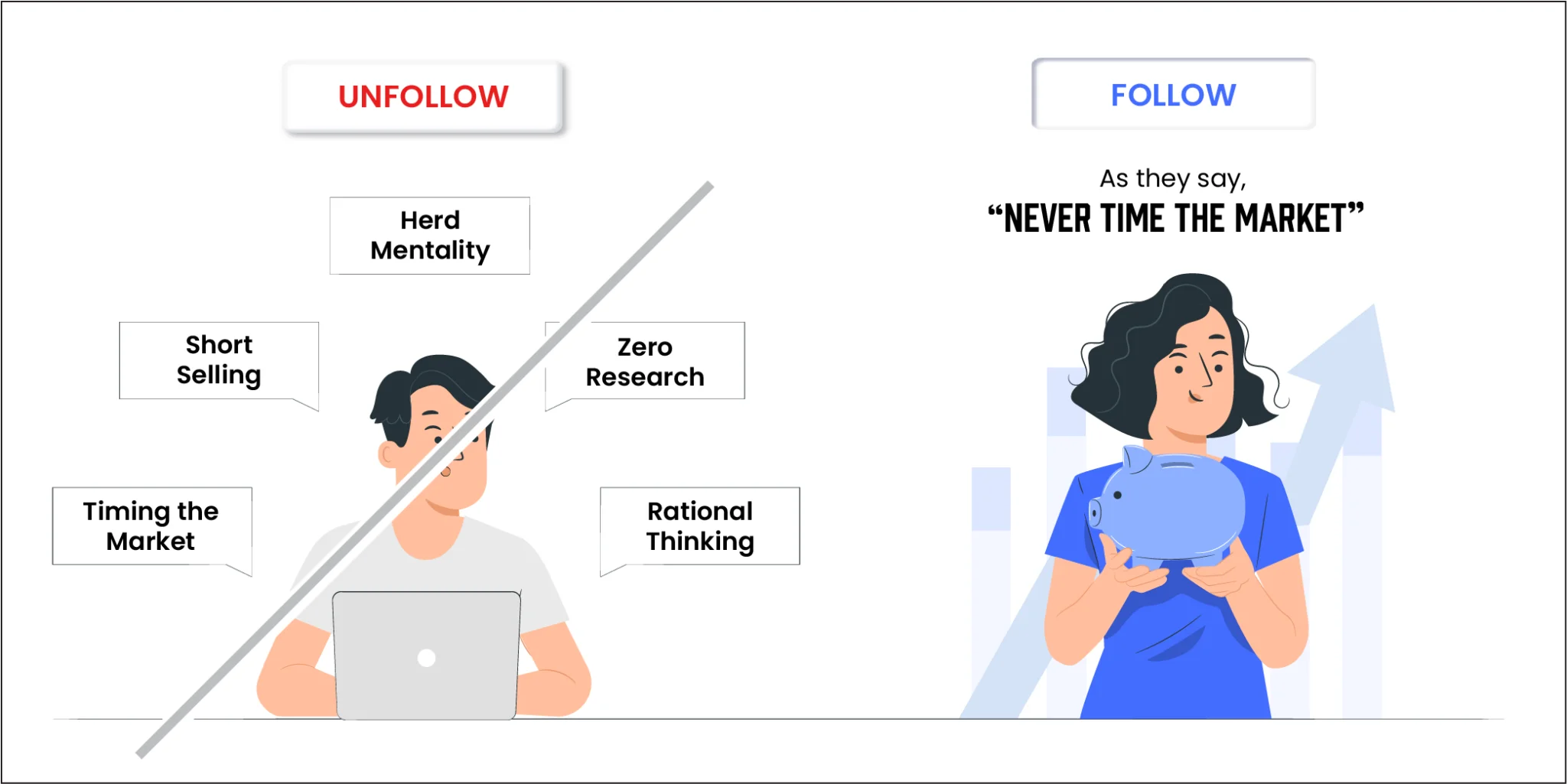

Rules regarding carrying forward losses

If there are losses in business such as losses under capital gains, losses due to natural calamity, or others, it is important to note that an ITR must be filed within the due date given for the financial year.

The failure to do so will lead to more financial losses as a tax payee will not be able to carry forward the losses in the next years to avail an offset in the income.

For instance, a tax payee suffers losses in the financial year 2022-2023. Then it is essential to file an ITR for the assessment year 2023-2024 within the due date, which generally would be July 31, 2023.

So, the tax payee can carry forward the losses and avail an offset in the total income to be taxed in the next financial year.

Delays regarding receiving refunds

According to Section 244A of the Indian Income Tax Act, 1961 and amended by the Finance Act, 2022, if we pay excess taxes, we can request a refund. It is granted after thorough verification. Once granted, we will receive a refund within three months of the date on which the refund is granted.

However, if we do not receive a refund within three months, then we will receive an interest of 0.5% on the total refund amount for every month or part of a month from the date within which we must have received the refund.

However, if there is a delay in receiving the refund due to reasons attributable to the tax payee, then the period of delay is excluded from the period for which the interest is payable.

For receiving such refunds, it is important to file an ITR within the due date of the assessment year and upload the correct details and documents for refunds.

Conclusion

Filing an income tax return within the due date will help you avoid a penalty fee, as well as, the interest amount. So, it is important to check the due date for each assessment year and file an ITR within the date.

It will help us in availing loans, insurance cover, buying properties, and other assets for investment. In addition, we can claim and avail refunds, carry forward the losses in business to offset income for the next year, and avail the proof of net worth.

It will help the Department of Finance of the Government of India to avoid the collection of black money. For instance, our savings can be considered black money if we do not file an ITR.

Moreover, if there are any foreign assets and outgoing cash flows, we need to disclose them while filing returns. Otherwise, there will be action against those who hide such assets.

Furthermore, paying an ITR on time will help the government authorities accelerate development activities within the country with a huge capital in hand.

In case of natural or man-made calamities, government authorities can help those affected by announcing packages for victims and the development of regions that suffered losses. This is why it is important to file an ITR within the due date and contribute toward the development of the country.

Sing up koshex

Frequently Asked Questions

Which penalties will be included for filling an ITR after the due date?

For filing an ITR after the due date, you need to pay penalty fees based on your income and 1% interest on the total tax amount for the total number of months preceding the due date.

Do I need to pay a penalty fee for filing a revised ITR?

If you pay a revised ITR within the due date, there will be no penalty fee. However, if you file a revised ITR after the due date, you need to pay a penalty fee. The due date to file the belated/revised ITR for the assessment year 2022-2023 is December 31, 2022.

Leave a Comment