The allure of Initial Public Offerings (IPOs) has always been irresistible to investors looking for quick profits. The promise of listing gains – those sweet returns achieved on the day of the stock’s debut – has driven many to flock to IPOs year after year. But as we delve into the IPO performance of 2024, it’s clear that listing gains may be losing their spark.

The Reality Check: Fading Listing Gains

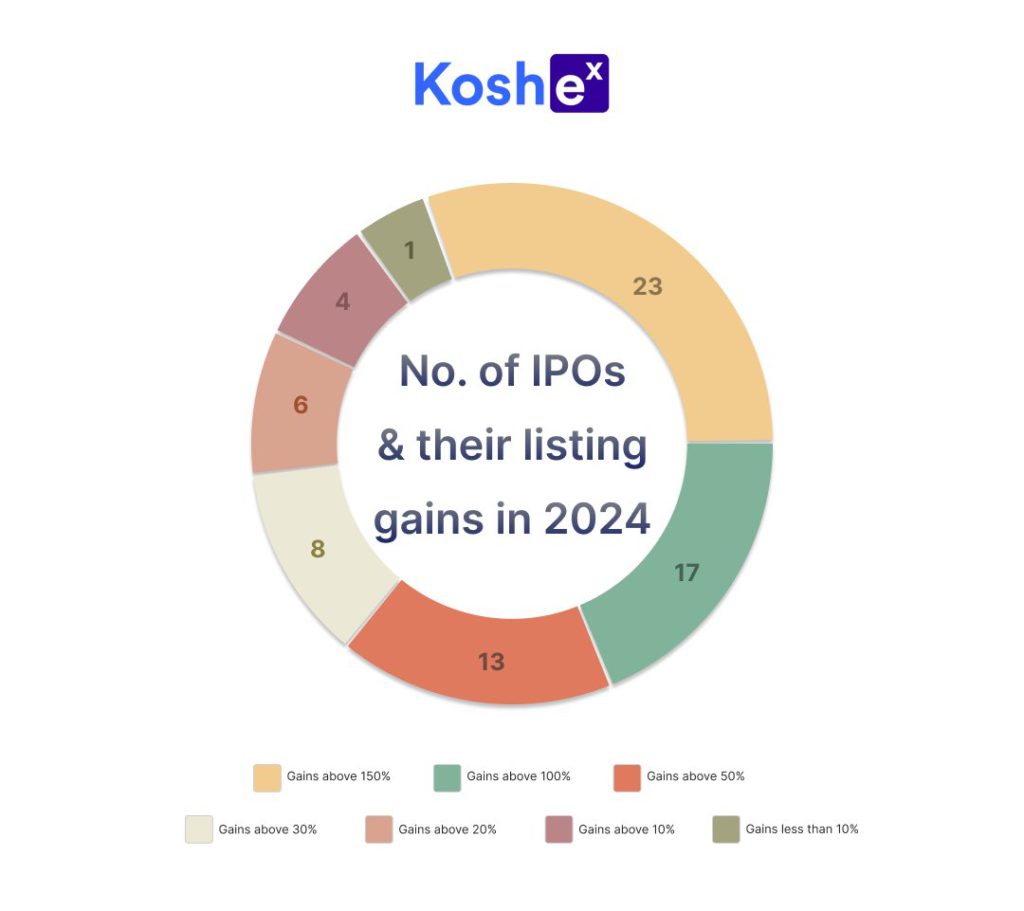

When we analyse the IPOs of 2024, we can see an eye-opening story. Out of the 93 IPOs that were listed in 2024, only a handful have delivered the extraordinary returns investors dream of:

In 2024, 72 IPOs were listed on a positive note on their listing day.

However, if you think that most of those IPOs gave extraordinary triple-digit returns you would be very disappointed.

Because,

- Only 1 IPO gave gains of over 150% and 6 IPOs delivered returns of more than 100%.

- 8 IPOs recorded listing gains over 50%.

- 23 IPOs saw gains of over 30%.

- 4 IPOs witnessed gains of more than 20%.

If you apply for IPOs to get triple-digit returns on the listing day, you would have been pretty disappointed in 2024 as only over 7% of IPOs saw those types of listing gains. If you are betting your portfolio on these outliers, you might find yourself underwhelmed by the majority.

Source: Numbers taken from InvestorGain.com

Big IPOs, Big Disappointments

We may have thought that IPOs with big issue sizes may lead to big returns. However, 2024 has debunked this myth in spectacular fashion.

Take the Hyundai Motor IPO, for example. Despite an issue size of over ₹27,000 crore, it traded at a 7% discount on the listing day, delivering a harsh reality check to investors.

Apart from Hyundai Motor, 2 other IPOs had an issue size of over ₹10,000 crore and they saw gains less than 10%. 5 IPOs had an issue size of over ₹5,000 crore, of which only one IPO saw listing gains over 100%.

Clearly, big names and big numbers don’t always translate into big returns.

The Silver Lining: Small-Cap IPOs

While the giants stumbled, small-cap IPOs (issue sizes under ₹500 crore) shined with promise.

Here’s how they performed:

- 26 small-cap IPOs opened on a positive note on the listing day.

- 5 IPOs recorded listing gains of over 100%

- 3 IPOs recorded gains of over 50%.

- A whopping 9 IPOs saw gains of more than 20%.

Out of the 7 IPOs that recorded over 100% listing gains in 2024, 5 IPOs had an issue size of less than 500 crore. This suggests that for investors willing to explore smaller opportunities, the potential for substantial returns is much higher.

What 2024’s IPO Market Teaches Us?

Here’s what we have learned from the 2024 IPO story so far:

Large issue sizes don’t guarantee success – Big-ticket IPOs can disappoint, and size alone isn’t a reliable indicator of performance.

Small IPOs hold hidden potential – With lower issue sizes, the chances of notable returns appear significantly higher.

Dreams of massive listing gains are fading – The IPO landscape is delivering fewer “extraordinary returns”, making realistic expectations a necessity.

So, Are IPOs Still Worth It?

Despite the challenges, IPOs remain an intriguing investment option for many retail investors. The thrill of chasing listing gains isn’t completely gone – it’s just harder to find. For those willing to conduct thorough research and focus on promising small-cap IPOs, there’s still room for success.

However, treating IPOs as a reliable path to wealth is a gamble better avoided. Instead, consider them as part of a diversified investment strategy to reduce your risks and increase your returns.

For both seasoned investors and newbies, the key takeaway for 2024 is simple: shift your focus from hype to strategy. By doing so, you might not only reduce risks but also uncover the hidden gems in the market. Always remember that it is important to research everything thoroughly and not rely on random influencer suggestions and Reddit threads

Leave a Comment