We all strive hard to make good financial decisions. Though being good with money sounds like a complicated art form, we are here to tell you how simple it is.

We have been reading more and more about good financial habits and how we can make them a part of our lives. You might have been imparting these habits in your daily life for a while now, but how do you know that you are good with money? If you have been saving and making judicious use of your money, does that mean you are already good with money? Read this article to know more about the signs that you are good with your money.

They Stick To Their Budgets (most of the time)

People who are good with money create a budget every month and try to stick to it. They are aware of their income and they track their expenses diligently. By creating and following a budget, they avoid living beyond their means and also, take complete control over their finances. Also, managing unexpected costs will be less frustrating if you know your numbers.

They Differentiate Between Wants & Needs

When you read the title, you might be thinking that you are an adult and you can obviously differentiate between wants and needs. But the truth is spending money to buy things that we want feels very good and if we continue to buy things that we want, we tend to forget the meaning between the two.

For example, transportation is a need but a new car probably isn’t. Food is a need but eating out every other day, especially if you are on a strict budget, probably isn’t. Once you understand the difference and follow a tight budget, you will be able to significantly change your money habits.

They Don’t Make Emotional Purchases

We all tend to give in to our emotions every once in a while and make impulsive purchases. But if emotional purchases become a habit, it will burn a deep hole in your wallet. It’s hard not to make impulse purchases these days, as every social media app constantly throws ads on our faces.

If you are someone who makes impulse purchases all the time, then try making a time rule. For example, if you saw an ad for a shoe and you want to buy it immediately, try giving yourself 24 hours before you make the purchase. Some people can set 24 hours while some might need 2 weeks before they make a rational buying decision. Set your time frame and think twice before buying any unnecessary stuff.

They Are Not Afraid To Invest

We all have been taught to save every month. Even though it is not a bad idea to put your money in a bank savings account, you can try choosing conservative instruments like Recurring Deposits. If you want to get better returns than a bank savings account but don’t want to take high risk, you can invest in Smart Deposits (i.e) Liquid Mutual Funds.

On top of putting money in insurance policies for tax-saving purposes, you can also choose ELSS (Equity Linked Savings Scheme). If you allocate ₹40,000 every year to invest in insurance, you can try putting ₹10,000 in ELSS.

In The End…

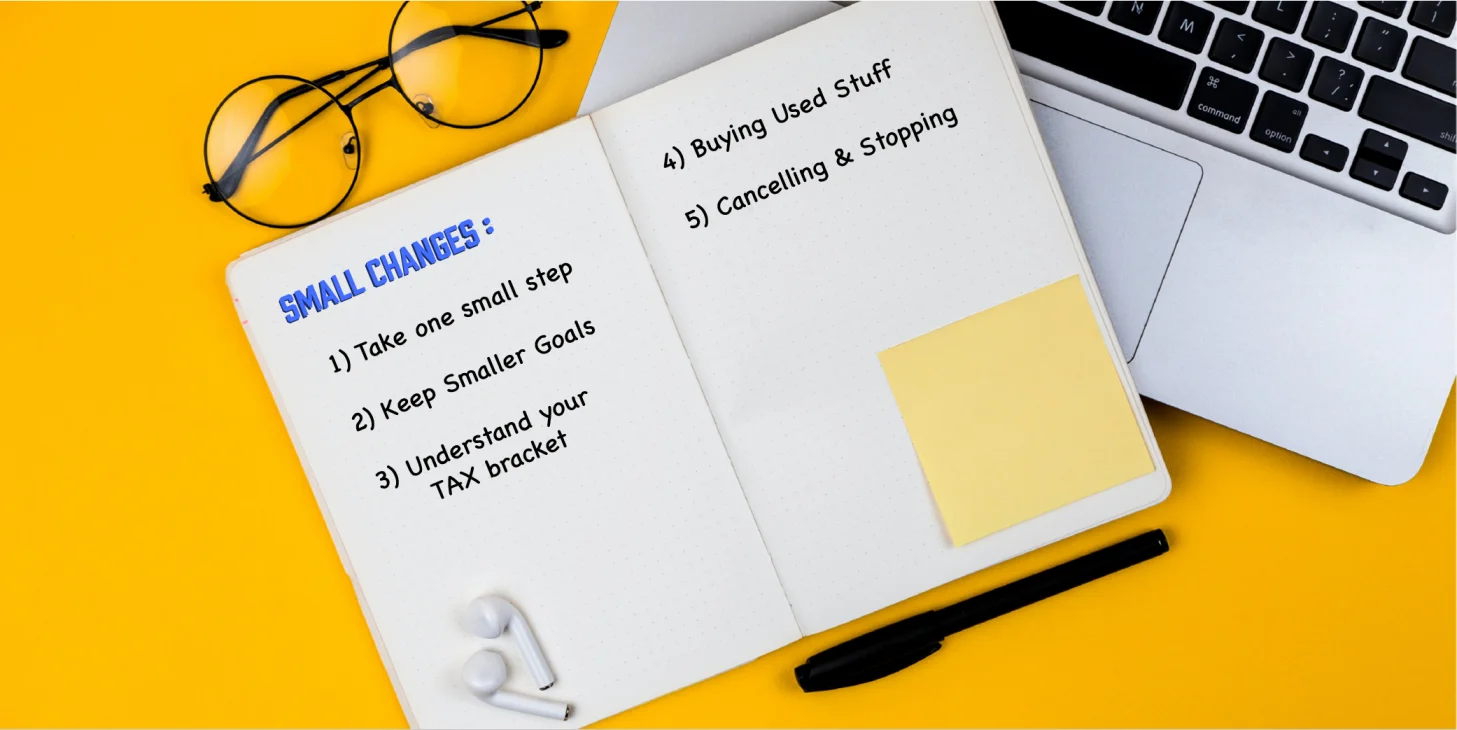

Becoming good with money takes time as most schools and colleges haven’t taught millennials and Gen Z about personal finance. When we become adults, we are pushed to learn about money and how it works. So, if you are struggling to track your expenses or stick within your monthly budget, don’t worry. Just keep on trying and you will eventually get the hang of it. Handling one’s finances doesn’t have to be complicated, as you can easily do so with Koshex.

Koshex helps you automate your finances and it will also customize an investment solution for you. You can choose between several different financial products, including Mutual Funds, Smart Deposits, and Digital Gold. Get better at managing your money today with Koshex!

Leave a Comment