The road to accumulating wealth by saving your money can be a long one. Although it will take you to a place of financial independence, you may meet several bumps on the way.

For many people, the first hurdle is to adjust their lifestyle to put a part of their income aside into their savings.

If you are in a similar boat and are struggling to save the desired amount, your solution lies in budgeting. To understand what it is, you don’t have to go far from home.

You must have seen your parents run the household on a strict budget to account for everyone’s needs. In your childhood, hearing that a toy was out of the budget must have been a common situation. It happened because other things took priority.

Maintaining a cash flow and also looking to increase inflow requires consistent budgeting!

Don’t fret if you have little idea of how to go about it. In this article, we have explained zero-sum budgeting in detail. We have also outlined a few ways to help you increase your cash flow while following this budget.

What Is Zero-Sum Budgeting?

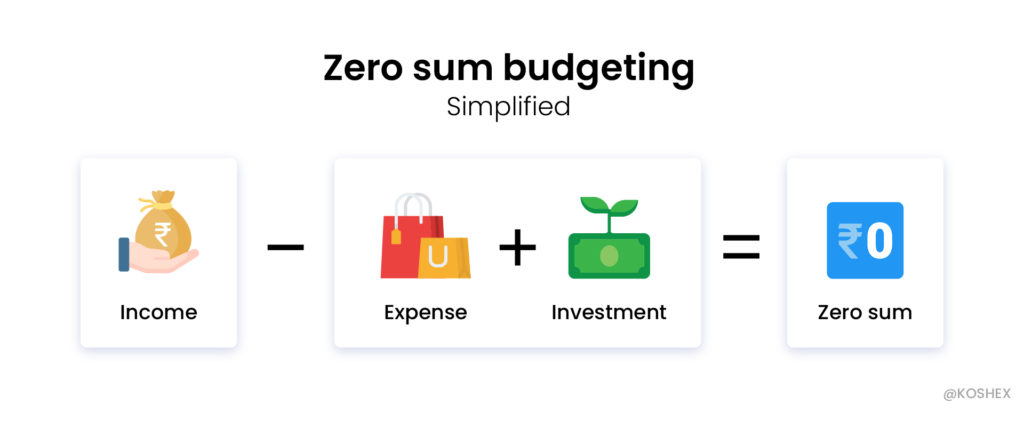

More popularly used to run businesses, zero-sum budgeting is when the difference between your expenses and income is zero. It is a way to ensure that you know where you are putting every single rupee from your income. You can either put your money into savings, investments or towards your expenses.

It is particularly useful for people who say they don’t know where their money goes. As you do this, you set up a mechanism where every single rupee has a designated job to do.

How to Prepare a Zero-Sum Budget?

Here are the steps to help you prepare a zero-sum budget and stay on top of your finances.

Write Down Your Income

The first step is to calculate your net in-hand income. It should include everything like paychecks, passive income, and money that you are earning from a side business.

However, note down only the income that you are getting in your hand. It should not include your taxes. In other words, it is the amount that gets credited into your bank account every month.

To create this budget, you can either use spreadsheets or more advanced apps. You can also do it with a traditional pen and paper.

Write Down Your Monthly Expenses

As part of this step, you will have to write down every expense you tend to have in a month. It must include regular expenditures like food, utilities, fuel, and rent, etc. These are the items that will remain constant in your budget.

However, there are a few expenditure items that will vary every month. For instance, you could be traveling in a month. To account for such expense buckets, it is advisable to make a new budget every month.

You can add a miscellaneous header in your expense to account for such expenditures. You can also leave a little room to account for emergencies. However, it is not the money that you can spend to fulfill your temptations like buying a new pair of denim pants. Holding this extra amount at the end of the month and adding it to your savings is advisable.

Write Down Your Savings and Investments

Experts suggest that every individual must save 30% of their salary. While you may find it tough in the beginning, you can set your own realistic target. As your income will grow, it will become easier to inch closer to this goal.

To secure your future financial health, it is advisable to make savings and investment a priority. It doesn’t matter how much your current income allows you to put into this bucket. Always remember that every single penny counts. The earlier that you start investing, the higher are your returns.

When you begin prioritising saving your income, you will notice a change in your behavior. You will start filling out this bucket as the first thing when preparing your monthly budget.

Prepare for and Write Your Seasonal Expenses

Apart from regular expenses, everyone has other significant expenditures that may come once or twice a year. Birthdays, anniversaries and festivals are some examples of this.

Although these expenses may come once in a couple of months, they have the capacity of denting your savings.

To avoid an impact, you can start accounting for them now. For instance, if you know that you spend around INR 24,000 every year on your festivals, you can divide it by 12.

Saving the resultant amount of INR 2000 every month will be easier instead of making way for the entire sum in one month. It will enable you to achieve your goals and live your life to the fullest without impacting your finances adversely.

Similarly, you can budget for other expenses like your car servicing, insurance premiums and property taxes in advance.

If it seems like a daunting task now, it may help to note that it’s a one-time activity. You can save this calculation for later and use it in the years to come. Of course, you can change the amounts and add or remove items as needed.

Subtract Your Expenses From Income to Arrive at Zero

Now comes the tricky part. As explained above, the purpose of zero-sum budgeting is to equal your expenses to your income. However, it is not going to be easy, and achieving this balance may take time.

In the beginning, you will overshoot your expenses, and the figure of zero will remain elusive. Experts say that it may take as long as three months to get the hang of budgeting.

If you continue spending more than you earn, you may want to make a few lifestyle changes. For instance, you can start cooking your own food instead of ordering in. You can try shopping online and use coupons to save money instead of going to brick-and-mortar stores.

However, remember one thing. Your zero-sum budgeting will be successful when every single rupee has a designated job to do. If even after creating this budget, you have some money left, your exercise is not complete. You can choose to do anything with your extra cash.

It is advisable to put this extra money into your savings or to clear your debt. The latter should take precedence for your financial wellbeing.

Can People With Irregular Income Follow Zero-Sum Budgeting?

Yes, absolutely. If you have irregular income and get variable amounts at different times in a month, there is no need to fret. All you need to do is to create a budget as per your lowest income month.

Go with that amount to prepare different buckets of expenses and cover the most important ones first. For instance, even if your income is low in a month, you will still have to manage rent, fuel and food.

If your income gets exhausted at this step, you may stop.

You can pick up budgeting as and when you receive your next payment. If you end up making more money than you need for managing your expenses, you can go ahead and put that amount into your savings and investments.

How Can Zero-Sum Budgeting Help in Improving the Cash InFlow?

As you will become an expert at zero-sum budgeting, you will observe an improvement in your cash inflow. In other words,

it will help you generate more cash to account for your savings and investments. It is also the reason several businesses often go to square one for budgeting and forecasting purposes.

Is There Any Disadvantage of Zero-Sum Budgeting?

The biggest downside with zero-sum budgeting is that it is time-consuming. Especially if it is your first time with it. Another issue that it requires you to track your expenditure consistently.

As you go about it, you may realise that you are not accounting for unexpected expenditures like replacing a broken phone, attending a friend’s wedding or impromptu travel plans.

However, there is an easy way to go about it. You can create several headers in your budget like an emergency fund and savings to manage such expenses.

In summary

Zero-sum budgeting is your solution if you often wonder where your money goes. It will put every single rupee that you earn to a specific use. Moreover, it will increase your cash flow for priorities like creating an emergency fund and investments.

Leave a Comment