Motivate Yourself To Save Money

Are you finally serious about saving money? We are going to tell you how you can motivate yourself to stay focused on your journey to achieve your financial goals.

Saving money is considered to be one of the best qualities one can possess. You must have been taught by your parents to save money in piggy banks when you are small.

It is easier to save at a young age since you do not have any responsibility. However, saving money can become a tad bit difficult when you start earning money since you will have several responsibilities, including paying bills, paying off debt, buying groceries, etc.

Finding ways to stay motivated is the key to accomplishing your goals. So, if you are someone who has gotten a job recently and have decided to save money, this article will help you stay motivated in your journey.

Why having the motivation to save money is important

Firstly, you should ask yourself why you are saving. You should also decide how much you need to save and how long you need to save.

You don’t have to save only for important things like for retirement or for building an emergency fund. You can also save so that you can splurge on an expensive gadget or a luxurious car.

When you have a goal in front of you, it will motivate you to save money.

You can also keep a picture of what you want to buy on your cupboard or a board, as the more you look at it, the more you will push yourself to save money every time you get paid.

Build A Budget

Every article on the Koshex website talks about the importance of building a monthly budget.

So, how do you build one in the first place? Once you have identified your goals, you can write down how much money you need to save each month to achieve that goal. It can look something like this.

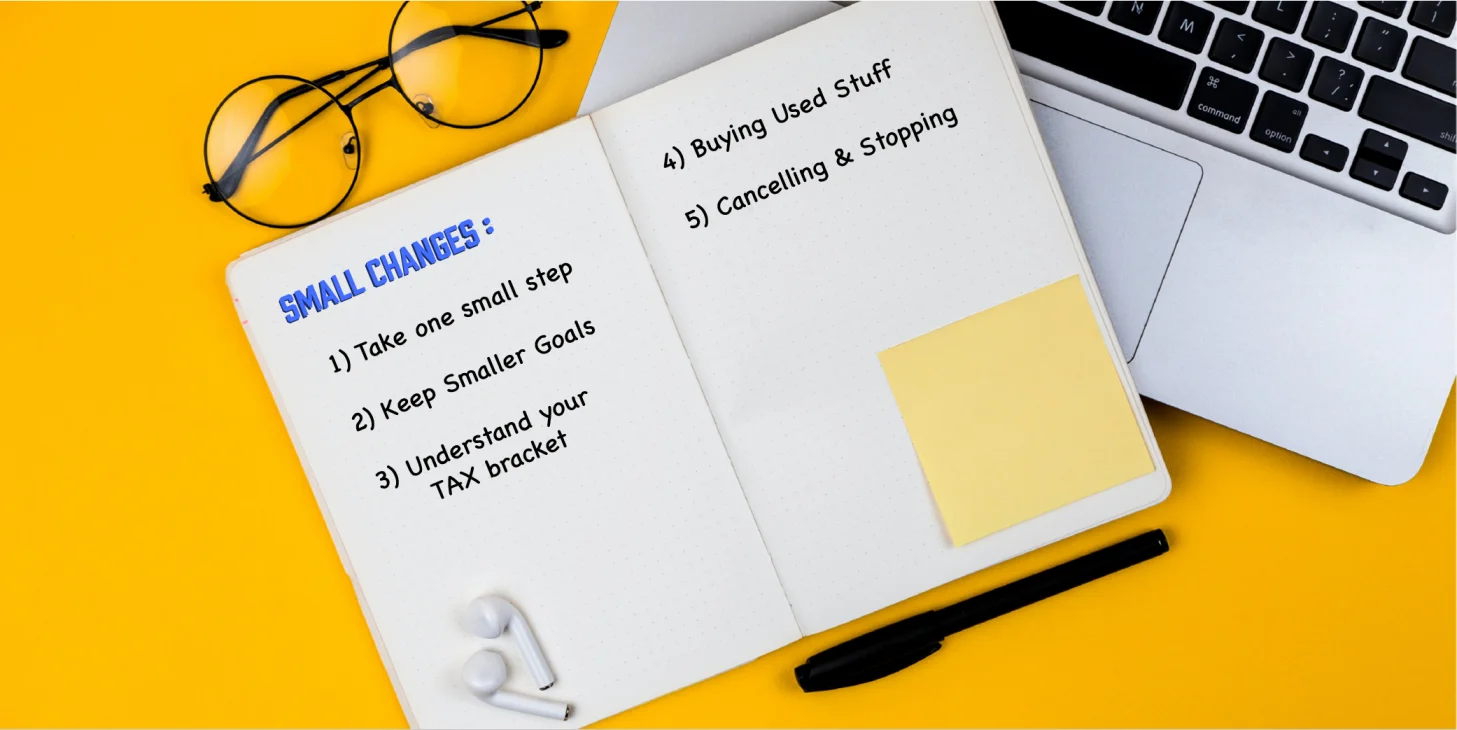

Save money motivation Tips

- Goal: Buying a new phone

- Target Amount: ₹70,000

- Target Time: 8 months

- Amount To Save Every Month: ₹8,750

Now, you have to save ₹8,750 every month and you should put that on your monthly budget.

This process will help you create a plan on how you can save this amount and also, cut down on your spending so that you can save the required amount.

No Impulse Spending

When you have gotten a job for the first time, you might be tempted to buy things that you don’t need.

It could be fancy wall art or a quirky T-shirt or something that you saw in an Instagram advertisement. These small purchases can add up quickly and before you know it, you might be spending a lot without realizing it.

So, before you buy anything, make sure to ask yourself whether you will use the product for a long period or if you are buying it only because it looks pretty on the website.

Automate & Track

Automating your savings process is the single best thing you can do to better your financial life.

You can choose a recurring deposit scheme at your bank and it will automatically deduct the amount from your account directly. This will help you save money without having to do it manually every month.

You can choose Smart Deposits, which will give you higher returns than a bank savings account, and you can set up Auto Pay for automatic deductions.

After automating your savings, you should track your savings by logging it in a notebook or spreadsheet. You can also note down how much money you have made by saving, and this will motivate you further to save money and stay focused.

Celebrate, Share & Invite

If you have achieved your financial goal, (i.e) you have bought a gadget or a car or anything you wanted to buy, you should pat yourself on the back for saving patiently and fulfilling your dreams.

You can also celebrate if you have managed to save for three months consecutively. When you celebrate your short wins, you are more likely to stay motivated and spend within your budget.

Another best way to stay motivated is to let others know about your savings goals.

You can tell your inner circle about your savings goals and priorities and ask them to help you stay on track. To make saving more fun with other people, you can invite others to save with you.

You can invite your family members or close friends, and you can motivate each other to stay on track.

In The End…

Staying motivated to save money every month or every time you get paid might sound like a tedious task but it doesn’t have to be.

If you follow the above tips, you can stay motivated to save for your future needs and achieve your dreams.

If you are looking for a platform to automate your finances, you can head to Koshex! You can invest in Mutual Funds, Smart Deposits, and Digital Gold via Koshex, and you can also invest in a personalized portfolio, created by our AI.

Koshex helps you make better financial decisions, easily and without any hassle. Head over there and create an account today!

Leave a Comment