We have heard this and we have been hearing this for years. But financial planning and achieving your life goals is much more than sacrificing your favorite coffee.

Sacrifice More

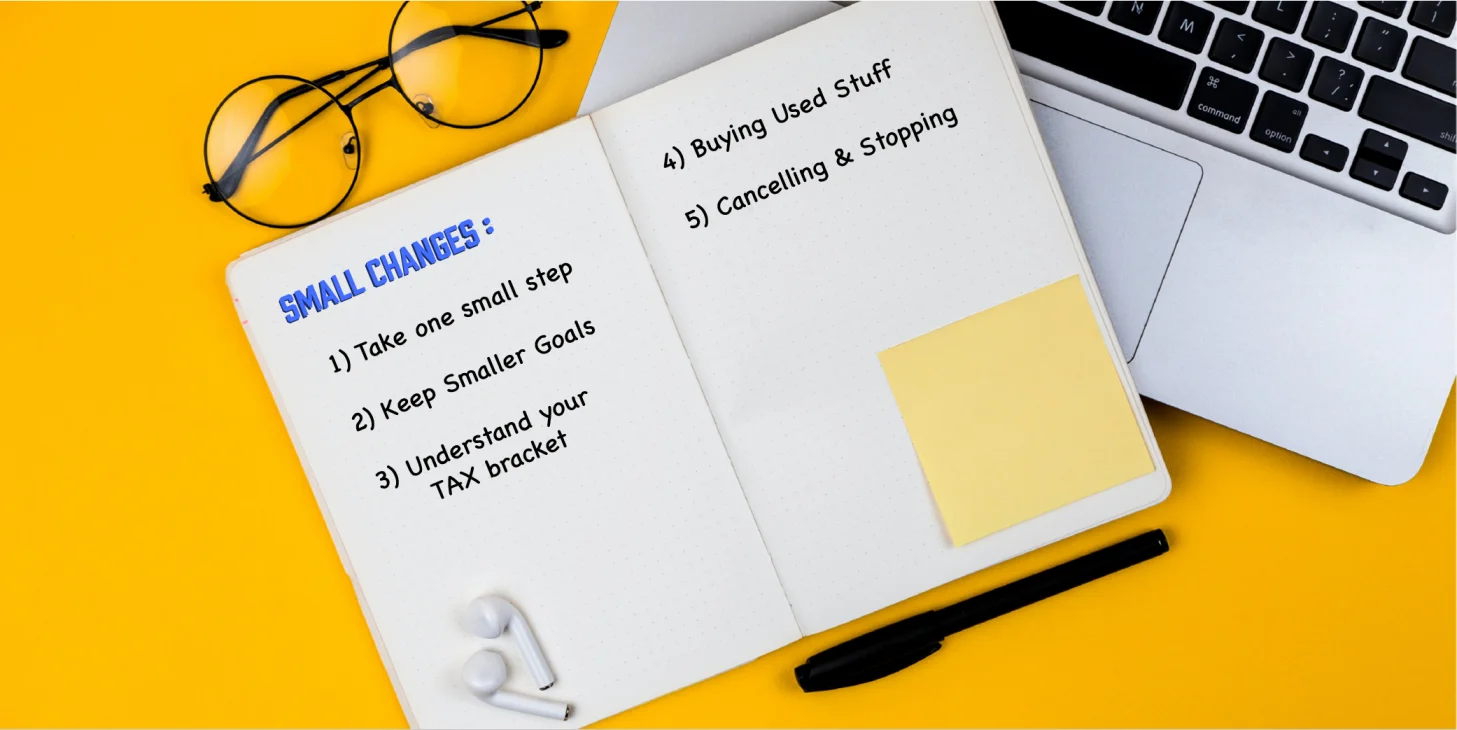

With the internet bringing everyone closer together and giving everyone a platform to voice their opinions, there has been a lot of advice. If you go online, you can pretty much find advice about anything – be it exercising, dieting, skincare buying, gadgetry, financial wellness and so much more. A few years ago, there was advice about how small sacrifices made in your 20s can save you a lot of money when you become 40 or 50.

This advice might sound something like this: “Stop drinking coffee at Starbucks, and save that ₹300,” “Stop ordering out too much, and save that ₹1000,” “Stop paying for Netflix, and save that ₹700.” It was said that these savings will add up and become big in the future. There is nothing wrong with saving money. On our website, we have hundreds of blogs asking you to put a little bit in mutual funds via SIP every month. But the reason that we are not a huge fan of the above financial advice is because it attaches an element of discomfort and unhappiness to saving money and financial planning.

We all know it is easier to spend than save and saving money is not exactly something that brings a lot of pleasure. But cutting down on the things that bring you joy (i.e) enjoying the ambience of Starbucks and drinking a big cup of iced coffee, being cozy inside your home and eating the delicious slice of pizza, staying up until 1 AM to finish your favorite show, might save you money but also bring unhappiness and misery.

But why so? When you start equating saving money with sacrificing all the things you enjoy, it will make saving and planning for your finances look like a tedious task. Also, if you fail one day and get that Starbucks drink, you will feel terrible about not following the exact plan. Every small lapse or failure will discourage you from saving more or adopting new financial habits because you will think that you will fail anyway. The truth is you can save money without making sacrifices and here’s how you can do it.

Save The Extra

If you are unable to cut your expenses, then save the extra money. This could be a tax refund, a bonus at work, a cash gift etc. Saving this unexpected cash is easier as you don’t have to give up anything and put it into the savings account. Instead of putting this into your average bank savings account, you can consider putting this into Smart Deposits, which offer higher interest. If you are interested in Smart Deposits, you can create an account with Koshex to learn more and start generating higher interest for your extra cash.

Make It Fun

Saving money doesn’t have to be complicated and troublesome as there are several apps that make financial planning and saving money easy these days. You can find apps that will invest a certain portion of your money every time you swipe your debit card. Taking up fun challenges is a great way to save some extra money every month. For example, tell yourself that you will save 10% of the amount that you spend on Starbucks. If you buy a coffee for ₹300, you can save ₹30. You can do this for every time you splurge on anything. Maybe you might feel like saving 20% one day and 5% another day and nothing some days, and that’s completely okay.

Automate Savings

If you have decided to save some money and find it incredibly difficult to do it at the beginning of every month, you can automate the process. We all have sudden bursts of motivation some days to save more money for our future needs. During that time, you can automate your savings process so that you can automatically save a portion of your income every month. You don’t have to worry about anything as the money will get automatically deducted from your account. This is the best way to save money for those who don’t want to put in a lot of effort to save their money.

Cut Down Here

This last tip might sound contradictory but it will help you save a lot of money. Cutting down on Starbucks and Domino’s might not help much but cutting down on other extravagant purchases will. If you live in an expensive place, you can move to a different place or flat to save on your rent. You can rent furniture instead of buying new ones or you can buy them in secondhand stores. Instead of buying clothes during a sale, you can try online sites, which will exchange your old clothes for new ones, and sites that can help you buy pre-owned clothes.

In The End…

You do not have to sacrifice a lot of what makes you happy to save money. By saving extra cash, making the entire process fun, automating your savings, and cutting down on some purchases, you will be able to save money and make it a habit in no time. Try not to associate the word ‘saving’ with ‘sacrificing’ because that’s not true.

If you would like to automate your finances and invest in a hyper-personalized investment portfolio, you can head to Koshex. The AI at Koshex will manage your finances with ease for FREE. Go to Koshex today and get your financial life on track!

Leave a Comment