Over our life, we hear a lot of financial advice. Some of them have been touted as the best ones over the past few years, but we are here to tell you otherwise.

Our families play a large role in helping us form good financial habits. We can agree how we get influenced by our family members, friends, colleagues and acquaintances all the time while making crucial investment decisions. Let’s be honest here: If we want sound, rational and well-researched financial advice, it is best to reach out to a financial advisor. But financial advisors are not cheap.

So, most of us resort to receiving advice from those who can give it to us for free. Recently, blogs, tweets, WhatsApp forwards, Instagram reels have become the biggest source of financial advice for several young people. However, as the years have passed, many overrated financial advice have been passed down to us as well. Let’s sort them out here.

You Must Get A Credit Card

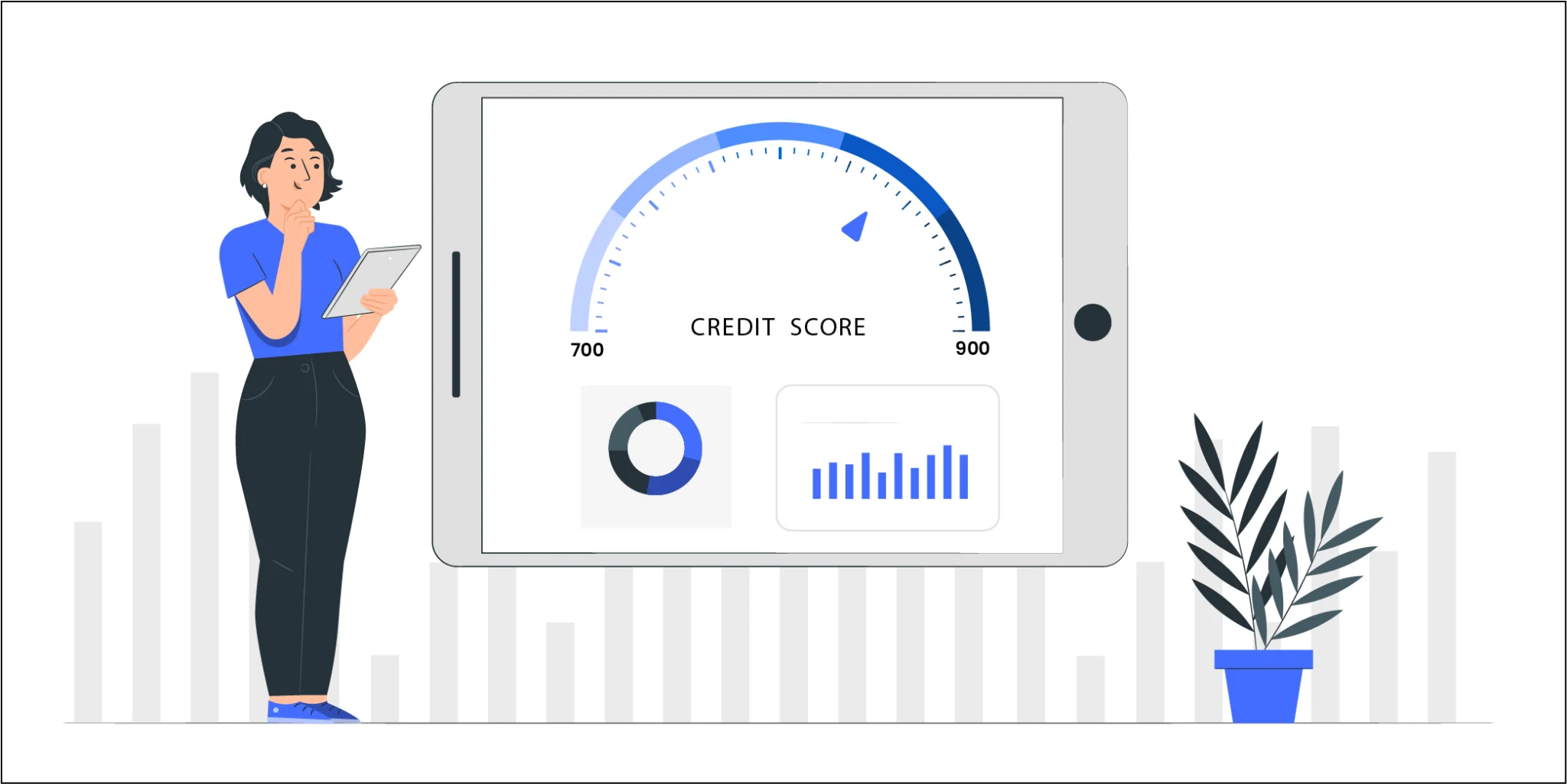

You must have heard this a lot: You have to compulsorily get a credit card to build up a good credit history. Having a good credit score is important, but that doesn’t mean you have to compulsorily get one to do so. Most of the time, young people get a credit card and they pay only the minimum balance due instead of the full bill amount. This can negatively impact your credit score. Unless and until you are good at controlling your spending, it is better to stay away from credit cards. Also, we have an entire blog about how credit scores work and how you can improve them without getting a credit card.

Stop Eating Out Too Often

There is another version to this advice as well and that is, ‘Stop drinking coffee from Starbucks’. If you are someone who has to pay off debts and other responsibilities but still drink coffee from Starbucks every single day, then you should reduce it to a great extent. The point to note here is that you have to control the frequency at which you do things.

Just because you stop drinking Starbucks coffee once a week or stop eating takeout every 10 days, you will not become a millionaire in 5 years. That’s not what actual millionaires do either. So, if you truly enjoy drinking that vanilla latte every Saturday, please continue doing so. However, if you buy Starbucks coffee despite having a coffee maker at your house, then you have a problem and you should start making good coffee at home.

A House Will Make You Rich

It is true that most of the millionaires put a portion of their wealth in real estate, but you have to understand that buying a house is a long-term investment. If you are someone who is looking to make a quick buck, buying a house doesn’t make any sense.

Buying a house comes with a lot of fees such as down payment, closing costs and so on. There are other things that you have to consider, including monthly home loan payment, utilities, insurance, property tax, buying furniture and decorations, etc.,

Also, when you sell your home, you will be paying out broker commissions that will cut into your profits. On top of that, if you are not sure where your career will take you or if you will be in the same city five years from now, real estate most likely isn’t the best investment choice for you.

Stay Loyal To Your Job

We have all read about ‘The Great Resignation’, which is the movement that caused many millennials and Gen Zers to leave their jobs, and demand more pay, more benefits, and better treatment. The older generations are known for staying at a company for decades. However, that advice might not be suitable for the current generations.

Vivian Tu, a 27-year-old TikToker who has made her first million on Wall Street, told Business Insider, “Being loyal doesn’t pay… If you stay at your job for too long, you may be losing hundreds of thousands of dollars because they know you’re not going to leave. You can only save as much as you earn, but you can always increase what you earn.”

In The End…

What we would like you to take away from this article is not every financial advice that is out there is perfect and some has been hyped for ages. The advice that has worked for the previous generations might not work for you, if you are someone who is young. So, it is alright if you want to find your own path and follow new advice and also, experiment on different things. You can try new things as long as you have researched everything completely and don’t put all your money in one basket.

Leave a Comment