Gone are the days when people used to retire after their 60s. The younger generations want to live life to the fullest and that includes retiring from their jobs as early as possible.

The FIRE movement, which has kindled the spirits of retiring early in many millennials’ hearts, is spreading across the globe.

However, accumulating a sizable corpus to live a worry-free retirement life is no easy feat. Let’s dive deep to see how millennials save money to retire early.

Retiring Early & FIRE

More and more millennials are looking to retire early these days.

According to the report titled, The Financially Independent Millennial’, which was released by CASHe, an AI-driven financial wellness platform in 2022 found that more than 34% of millennials have started saving for retirement already.

So, millennials are conscious about how their retirement life is going to be, hence they have decided to do something about it.

Where did it all start? If we take a deeper look at the topic, we can see how the FIRE movement has kickstarted the whole craze behind early retirement.

The idea of the FIRE (Financial Independence, Retire Early) movement was initiated by Vicki Robin and Joe Dominguez in their 1992 best-selling book “Your Money or Your Life”, and seconded by Jacob Lund Fisker in his 2010 book “Early Retirement Extreme”.

Just like the name suggests, FIRE is all about retiring early by adopting extreme saving methods. People who join the FIRE movement want to retire early by being frugal, using extreme saving methods like setting aside half of their earnings and generating an income through passive investments.

This movement is favored by those who want to quit their work, want to gain financial independence, and move their retirement age forward.

If you wish to know more about the FIRE movement and the different types of FIRE, you can read our article about it.

Be it following the FIRE movement or some other crazy ways to retire early, here are some methods that millennials are using to retire as early as possible.

Crazy Ways In Which Millennials Are Saving Money

Before you start using these crazy ways to save for your retirement, you need to figure out something important first.

If you are 25 right now and want to retire by 40, you need to save a sizable amount of money as your retirement fund. Do you know much money would you need to save? Here’s a quick calculation for that.

If you wish to retire early, you should be building a net worth of 25 times your estimated annual expenses.

For example, if your annual expenses are ₹5 lakhs, your retirement corpus should be ₹1.25 crore. Also, once you retire, you should withdraw only a maximum of 4% from your retirement fund each year.

(Quick Pro Tip: If you don’t what your current net worth is, all you need to do is create a free account with Koshex and we will tell you how much your current net worth is, so you can figure out a strategy to get to your target net worth).

- Start As Early As Possible

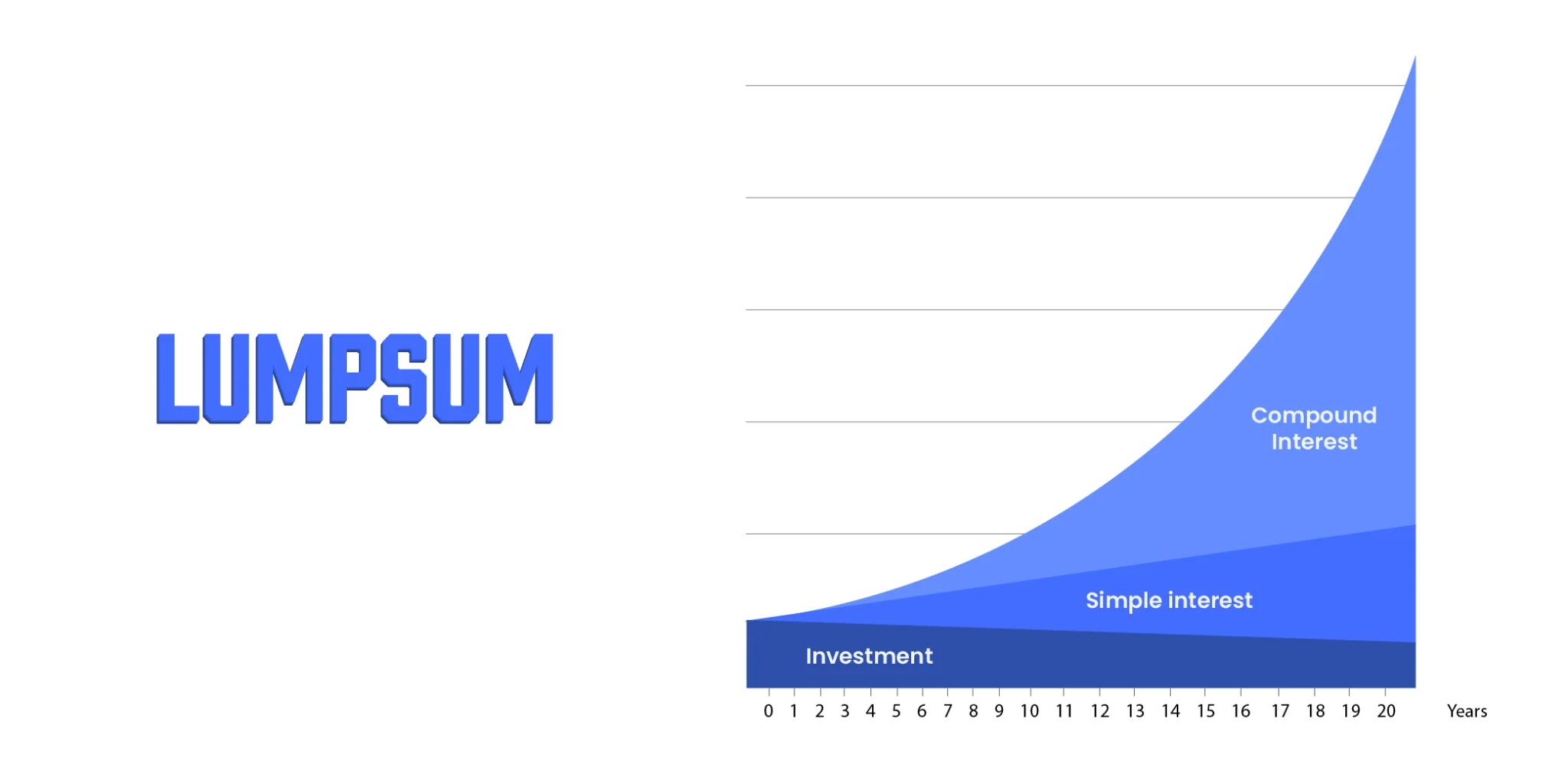

The earlier you start, the easier it becomes to save for retirement. Also, the earlier you start to save, the more you can accumulate for your later years.

When you are young, you can invest more money in risky assets, which will help you earn higher returns.

We all know that the power of compounding helps those who start their investment journey early. So, if you wish to retire early, start investing early as well.

- Get Strategic About Paying Off Debt

Facing down loans can be daunting, but it’s imperative to pay it off strategically. You might have an education loan, home loan or personal loan.

The first thing you can do in paying off the loan is by making regular payments. Try to pay off higher-interest debt first, like credit card debt.

- Managing Money Smartly

When you are trying to retire early, it is important that you learn how to manage your money so that you can save as much as possible.

It is crucial that you know how much money you have in the bank, and how your salary gets spent each month.

Knowing your position will help you understand how you manage your money and how you can become better at it.

- Invest In A Diversified Portfolio

Create a diversified portfolio that consists of large stocks, small stocks, mutual funds, ETFs, digital gold, and so on.

Invest in instruments that have different risk levels, so you can earn higher returns and build a sizable corpus. You can consider investing in small-cap stocks.

However, they could be more volatile than large-cap stocks but millennials have the distinct advantage of having a long-term time horizon and being able to ride out that volatility and take advantage of compounding.

- Automate Your Savings

If you struggle to save any money at all, you can automate your savings. This will ensure that once your salary is credited to your savings account, it will automatically get transferred to a different account.

If you get a raise at the start of the year, challenge yourself to live on what you earned last year and save as much of your new money as possible.

- Rethink Your Spending Habits

When you wish to retire early, it is all about saving money in every way you can.

Use coupons to reduce the amount you spend on groceries, food deliveries, movie tickets, and travel adventures. Try making a complete list before you shop for groceries.

Consider buying second-hand products, that still offer good value for your money. Visit thrift stores to see if you can buy what you want at a very low price.

Reduce your wants and focus on ways where you can save money every time you shop.

- Get Insured

Be it getting health insurance or vehicle insurance, it is important to get insured to help you during unforeseen events.

Insurance policies can also act as a way to grow your wealth and help save you taxes.

So, getting insurance is a good idea if you don’t want anything unexpected to throw you off your plan to early retirement.

In The End…

Early retirement is achievable if you plan, save, and invest smartly. Start your investment journey as early as possible and let compounding work its magic on your investments.

Set up a plan to pay off your debt quickly, manage your money efficiently, and analyze your spending habits every month – All of these habits will help you gain control over your money, which will help you stay on track of your early retirement financial plan.

If you are looking for a platform that will help manage your money efficiently, save automatically, and invest in personalized recommendations, you can create a free account with Koshex.

You can also learn more about other personal finance topics, such as budgeting, improving your financial skills, and investing in multiple instruments smartly, with our Blogs.

We also have easy-to-use calculators to see how much corpus you will accumulate when you invest in different investment instruments.

Your first step towards early retirement starts with Koshex.

Leave a Comment