Buying a house, driving a car and securing the future of children – these are a few dreams that motivate an average Indian to do better in life. However, achieving them requires patience and time. You must have heard how every penny saved is a penny earned. Time has a similar effect. In this article, we will see how every single day also matters in taking you closer to your financial goals.

When it comes to investments, time can be an ally or an enemy, depending on how you use it to your benefit. For instance, when you let your money stay invested for a longer time, the power of compounding comes into play. It is a powerful tool that underlies the adage, “Money grows money”.

What is Compound Interest And When Do We Need It?

When you choose to invest in a fixed deposit or savings account, you do so with the intention of earning interest. This interest gets added to the principal and helps in the accumulation of enormous interest. This resulting increase in your initial investment is called compound interest.

It is one of the core concepts that make investments the assured means of wealth accumulation that it is today.

Compound Interest Vs. Simple Interest

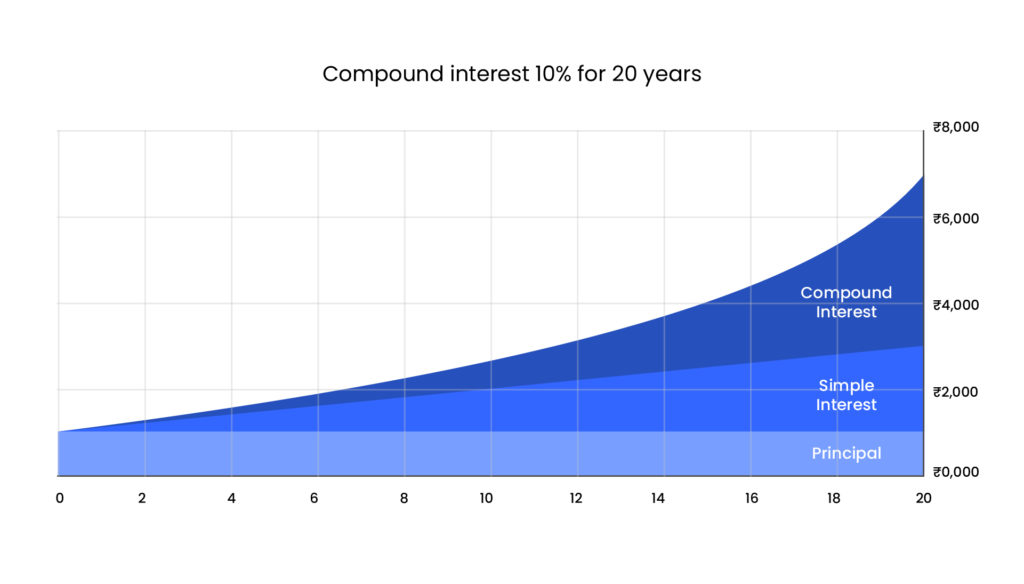

Although it is easy to confuse the two terms, there is a big difference between compound and simple interest. The latter is a substantial interest percentage that you earn on your deposit every year. Calculating compound interest, on the other hand, is a bit more complex and the returns on your investment are always higher when the interest is compounded annually.

Due to the same reason, you may want to be cautious when taking out a loan. Your liabilities may increase exponentially when the interest is compounded periodically. As long as you are aware of the difference between the two terms, there won’t be any unpleasant surprises throwing you off the rails.

Impact Of Power Of Compounding On Your Savings

The frequency at which your interest gets compounded plays a crucial role in inflating your investment. You may come across various standards of the frequency of compounding, as it can be daily, monthly, or even semi-monthly. The more the frequency of compounding, the higher is the effect on the initial amount. Due to this reason, you may want to select a lower compound rate that gets compounded frequently instead of a scheme with a higher simple interest rate.

For beginners, it may come as a surprise, but the compound interest on INR 50,000, compounded 10% annually, is less than the compound interest on INR 50,000 compounded 5% semiannually when calculated for the same period.

As you earn interest-on-interest, you end up making heavy returns on your investments. It is the reason you will often come across the term, ‘power of compounding.‘

How Does Compound Interest Work?

Compound interest keeps gaining steam over time. Every year you may earn a bit more interest and possess a slightly bigger balance. It is the magic that can grow your money over Rs 10,00,000 in only 25 years without making any new investments during this period. If you place your investments strategically, compound interest can be your golden shot to a financially stable life.

How Is Compound Interest Calculated?

Don’t worry if this is heading took you back to those painful math classes in school. Fortunately, there are great tools available these days that can help you with this calculation in a matter of a few seconds. You can use any online calculator to get the results.

However, if you would still like to understand the formula and put your grey cells to use, here is the formula for calculating compound interest.

FV= PV *(1+i)n

FV = Future Value

PV = Present Value,

I = Rate Of Interest

n = Compounding Periods

Is Compound Interest An Ally Or An Enemy?

When it comes to compound interest, the result may be one of the most profitable or depreciating tools to your pocket and savings. It all depends on whether you are investing your savings or taking a new loan.

If you are earning compound interest, you will end up with a much more significant amount as compared to the initial investment. On the contrary, if you have to pay the compound interest on a loan, you may even end up giving a larger amount of money than you had borrowed.

Explaining the effects of compounding interest is incomplete without understanding a few core concepts:

How Does Inflation Impact Your Investments?

Inflation is the rise in the price of goods over a period of time. While it may seem undesirable at first glance, a moderate amount of inflation is recommended for a healthy economy.

One of the main consequences of inflation is that it depletes the value of your money. For instance, your INR 100 bill can buy you a lot fewer things today as compared to a decade back.

Due to this reason, when you are investing your money, the returns should always be higher than the inflation. Otherwise, you will end up losing the value of your investments. It is the reason why you may want to understand the final returns on your initial amount before going ahead with an investment instrument.

Compound Annual Growth Rate (CAGR)

Yet another concept one needs to be aware of is the Compound Annual Growth Rate (CAGR). It indicates the return rate that is necessary for an investment process to grow.

You need to make sure that you are aware of the annual payment rate (APR), as the method of calculation and the compounding period puts an impact on the monthly payment you make.

Who are the Beneficiaries?

The compound interest offers maximum benefits to the investors, however, the term “investors” can mean a lot of things. For instance, the banks. When banks lend money and the interest is reinvested they accrue quite a good profit from it. Additionally through compound interest, bank account holders receive interest on their bank accounts.

How Can You Avoid Paying The Charges Of Compound Interest?

From what we have seen above, while it is great to earn compound interest, paying it on your debts can be troublesome. The result can be more harmful than you can imagine. The good news is that most large loans, such as home loans and auto loans, make use of simple interest.

However, there is one common type of debt that makes use of compound interest. It is the debt you take on your credit cards. It may come as a surprise, but most credit card users are not aware of this fact.

Credit card lenders compound interest on your outstanding amount on a daily basis. This interest starts accruing after your interest-free time is over. It is also the reason that financial experts recommend paying your credit card bills well in advance and not waiting for the last date. You can also use auto-payment facilities to avoid such high charges.

Does Compound Interest Make You Wealthy?

Yes, compound interest arguably is the most influential force that can help you in accumulating wealth over time. There are several stories of how lenders, businessmen, and merchants, have used the power of compound interest for becoming and staying rich.

One of the best examples is that of Warren Buffett, who is one of the wealthiest people in the world by leveraging the strategy of a business that involved patiently and diligently compounding investment returns over a period of time.

Compounding In Mutual Funds

The underlying principle of mutual funds is to help investors make the most of their investments using the power of compounding. Investors gain profit when the amount of the fund of units goes up. If the investment is of a long-term period, the compounding power can help you to grow your investment by significant amounts.

Key Takeaways

Here are the key takeaways about compound interest.

- Compound interest is calculated based on the prime principle and includes the interest accrued in the past. For instance, the interest earned in the first year of your investment gets added to the principal for calculating the second year’s interest.

- The frequency with which the interest gets compounded plays a vital role in determining the final amount. The higher the frequency more will be the final amount at the end of the tenure.

- Credit cards are the types of debt that levy interest on a compounding basis. As it gets compounded daily, your liability can get vastly increased unless you clear your bills on time.

The answer to whether compound interest is your ally or enemy totally depends upon whether you are investing your hard-earned money or taking a loan to meet your financial requirements. While it can help in growing wealth and helping you secure your future with investments, the result is the opposite when it comes to debt. Thus, it is advisable to be wary of your debts that compound on a frequent basis and look for investment opportunities that compound!

Leave a Comment