Investing has become a buzzword over the last few years, with mutual funds shifting into the spotlight in the Indian market.

As a first-time investor, mutual funds may seem overly complicated financial instruments. You may not understand how mutual funds work or how to receive greater returns on investments.

This article will help you get insights and answer a few basic questions about mutual funds to get you started.

What Are Mutual Funds?

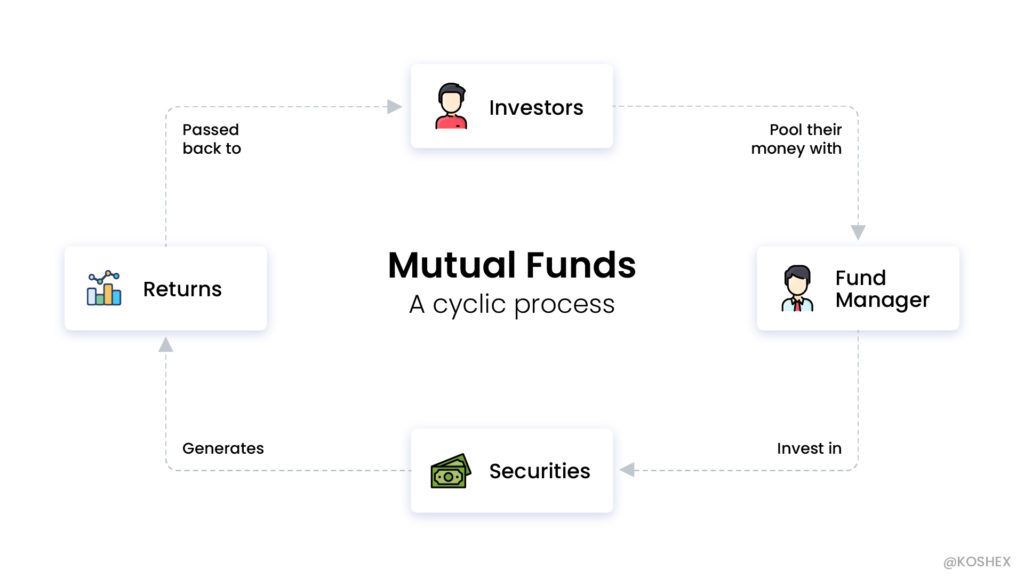

Mutual funds are collective investments that pool money from various individuals and institutional investors with a common objective.

A fund manager manages the pooled investments and decides to buy capital assets and securities like stocks and bonds. When you purchase a mutual fund share, you get a small stake in the investments included in that fund.

To better understand this concept, let’s look at an example:

Imagine a mutual fund as a big box of sweets. When you purchase a share in the box, you are buying one sweet from the overall box. You, therefore, have a stake in one small part of all investments in that box of sweets.

Why Should You Invest in Mutual Funds?

Mutual funds are a quick way to meet your financial goals. To get the best return for your investments, you can begin by asking these three questions:

- What is the purpose of your investment?

- For how long do you intend to remain invested (how long do you have from today)?

- How much do you expect to gain from your investments?

Let’s take a look at a real-life example of how these three questions can play a role in realizing your financial goals.

Ajay wants to save money for his daughter’s wedding. His daughter is 15 years old, and he expects her to get married by 25. This gives him ten years to build a corpus of 10 lakh INR.

Now that Ajay has answered these three questions, he has defined his investment goals for the next ten years. It is a great starting point for individuals beginning their journey towards investing in mutual funds. A clearly defined goal helps investors plan their investments in a more streamlined manner.

Structure Of Mutual Funds

In India, mutual funds are a highly regulated space and come under the purview of SEBI. It offers operational transparency and protects investor’s interests. Mutual funds are structured either as a corporation or a business trust, as determined by SEBI regulations under the Indian Trust Act, 1882.

A mutual fund is owned by shareholders. Virtually all mutual funds are externally managed. Their operations are conducted by affiliate organisations and independent contractors.

How To Get Started?

There are primarily two ways to get started with mutual funds. You can invest directly with the AMC (Asset Management Company) or through an independent advisor or broker. Regardless of what you choose, you will need to complete a KYC (Know Your Customer).

To complete the Video KYC successfully, you will need to upload a self-attested copy of your PAN card (validating your tax identification), Aadhar Card (validating address proof), canceled cheque (validating bank details for investments), and your signature proof. Ensure that the device you are using to upload these documents has a camera and microphone for recording a small video. After completing your video KYC, you will be able to make fresh investments within less than a week.

How Do You Know Which Mutual Fund To Choose?

Most investors pick mutual funds based on fund performance that is constantly flashed on financial news channels. Some rely on insider information like recommendations from a business acquaintance.

Others look for online reviews on financial websites or fund rating agencies. Although these are all smart ways to lead you to a quality fund, such decisions may go wrong sometimes as mutual funds are unpredictable and volatile.

Types of Mutual Funds

In India, there are many different types of mutual funds for investors to choose from. Regardless of the type of investor you are, you should be in a position to know the best options to fit your investment type. Reports indicate that there are over 43 mutual fund companies as of December 2020. With the plethora of options available and many more options in the pipeline, choosing the right one may seem like a daunting task. Nonetheless, armed with all the necessary information, choosing the right one will become a cakewalk.

Note: Before we delve deeper into the different types of mutual funds, it’s important to understand that different mutual funds have different risks and rewards. As a rule of thumb, the higher the potential return of investment, the higher the risk of loss.

Open-Ended Funds:

An OEF lets investors buy or sell units at any time after the closing of NFO (New Fund Offer: when the fund gets released in the market). OEFs, like other mutual funds, don’t have a maturity date and can be invested through systematic investment plans (SIPs) and systematic withdrawal plans (SWPs).

The key component of OEFs is liquidity, where units can be easily bought or sold at net value. They are ideal for investors who are looking for higher returns with a greater degree of monitoring. Given the greater volatilities, OEFs involve a higher degree of risk. At present, 60% of all mutual funds are OEFs.

Close Ended Funds:

CEFs are the opposite of OEF. These funds are open to investment only during the NFO. Once the NFO closes, no new investments are permitted, and investors must wait for the stipulated maturity period. At the time of maturity, investors can reinvest the funds in an OEF or withdraw funds that are calculated based on the fund’s (Net Asset Value) NAV. The NAV of the fund could vary depending on demand for the stock or other market factors.

Interval Funds:

An interval fund is a non-traditional type of closed-end mutual fund that periodically offers to buy back a percentage of shareholders’ outstanding shares.

Categories of Mutual Funds

Here are the different categories of mutual funds:

Equity Schemes:

Equity funds, also known as stock funds, are meant for investors ready to take higher risks to maximize their returns. The primary objective of these funds is capital appreciation. Equity funds predominantly invest in company stocks and have a high degree of risk associated with them. They are primarily invested in small, medium, or large-cap companies, which is determined by the company’s market capitalization.

As these funds’ portfolio reflects the prevalence of company stocks, the return on equity funds largely depends on the stock market conditions.

Debt Funds:

Debt funds are just the opposite of equity funds. Instead of focusing on Capital appreciation, debt funds focus on the security of your money. As the name suggests, debt funds are invested in different debt instruments like corporate and government bonds. Additionally, they are invested in non-conventional debt instruments like housing securities and retirement funds.

It’s a secure way to invest money and is a preferred choice for retirement savings. Debt funds are also a great alternative to a fixed deposit where the term is fixed, and the returns are almost guaranteed.

Money Market Funds:

MMFs are a little different from the previous two mutual funds. The main objective of an MMF is to provide a safe investment option to investors. Money market funds invest in market instruments, and the portfolio contains cash equivalent short-term liquid assets.

Benefits of Mutual Funds

Tax Benefits

One main reason you may want to consider mutual funds is because of their tax-saving benefits. Under Section 80C, salaried individuals can receive tax benefits for investing in Equity Linked Savings Schemes (ELSS). These funds not only provide great returns but also have a short lock-in period of 3 years.

Related: How to Save Tax in India | Tax Saving Guide

Low Initial Investment

Mutual funds are ideal to start investing for most individuals as it requires very little initial capital. Part payments in the form of SIP (Systematic Investment Plans) are a great way to spread out payments throughout the year. What’s more, this gives you the benefit of compounding. You can get started today with an investment as low as INR 100.

Convenience

By far, the biggest benefit of mutual funds is the convenience it offers to investors. Everything can be done online, from the comfort of your home. You can check how well your funds are doing, monitor whether the markets are favorable, or choose to invest or disinvest. Based on market observations, you also get the option to switch between funds or rebalance your portfolios to match your returns as per your financial goals.

One Time KYC

One unique feature of mutual funds is that they require a one-time KYC, after which you can invest in mutual funds indefinitely. After the KYC process is completed, you can invest across all 43+ mutual funds. You can carry out a completely paperless KYC on Koshex without any cost.

Key Takeaway

Now that you are all set, you can start by either investing directly or contacting a financial advisor or broker. You should start on your own only if you know what you are doing and have done sufficient research on the market. If not, you may choose an advisor or broker to guide you along the way.

Leave a Comment