Home Loan Tax Benefits (2023-2024): Calculate Tax Benefits, Sections for Tax Rebate & More.

Are you a homeowner looking to save big on your taxes? Understanding the home loan tax benefits can be the key to unlocking substantial savings and financial advantages. By familiarizing yourself with these benefits, you can make informed decisions that not only reduce your tax liabilities but also maximize your financial well-being.

Home loan tax benefits are designed to ease the financial burden of home ownership, allowing you to save a substantial amount on your taxes each year. By understanding and leveraging these benefits, you can enjoy increased financial flexibility and build a stronger foundation for your future.

By claiming deductions on the interest paid and the principal repayment of your home loan, you can significantly reduce the amount of income subject to tax. At Koshex, we help you navigate the path toward significant savings. Sign up with Koshex today and embark on a journey toward financial independence.

Calculation of Home Loan Tax Benefits

Calculating tax benefits for home loans may seem daunting, but with this step-by-step guide, you will be able to navigate the process with ease.

Follow these steps:

Determine the Loan Amount:

Identify the total loan amount taken for purchasing or constructing your home. This is the principal amount borrowed from the lender, excluding any additional charges or fees.

Understand the Interest Rate

The interest rate on your home loan plays a vital role in the calculation. It determines the amount of interest you will be paying over the loan tenure. The interest rate can vary depending on factors like market conditions, lender policies, and creditworthiness.

Analyze the Repayment Tenure

The tenure of your loan refers to the time period within which you are expected to repay the borrowed amount. It is usually expressed in years. The longer the tenure, the lower your monthly installments, but the higher the interest paid over time.

Calculate the Interest

To calculate the tax benefits, it’s important to determine the interest component of your home loan. The interest paid on the loan is eligible for tax deductions. Using the loan amount and interest rate, you can calculate the interest component using formulas or online calculators.

Understand Tax Deduction Limits On Home Loan

In India, tax deductions on home loan interest fall under Section 24(b) of the Income Tax Act. The maximum limit for claiming interest deduction varies depending on the purpose of the loan and whether the property is self-occupied or a let-out.

For self-occupied properties, the maximum deduction is capped at a specified limit of Rs. 30,000 if the construction of the property is not completed within 5 years. The period of 5 years is calculated from the end of the financial year in which the loan was taken. Otherwise, the deduction limit is Rs. 2,00,000.

Explore Principal Repayment Deductions

Besides the interest component, the principal repayment also offers tax benefits. Under Section 80C of the Income Tax Act, you can claim deductions for the principal amount repaid, subject to a specified limit. However, note that this deduction is part of the overall limit under Section 80C, which includes other eligible investments and expenses.

Example

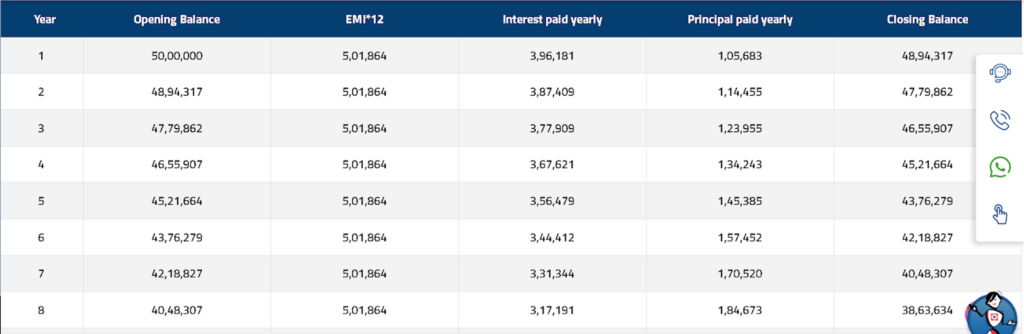

You have a home loan of Rs. 50 lakhs with an interest rate of 8% per annum. The loan tenure is 20 years. Based on these values, you can calculate the interest component and principal repayment using formulas. It is important to consider the tax deduction limits for interest and principal repayment.

The formula used in calculating the EMI

EMI= (PxRx(1xR)^N)/((1+R)^(N-1))

where, P= Principal Amount

R= Rate of Interest

N= Loan tenure

The monthly EMI is Rs. 41,822

The yearly loan repayment is Rs. 41,822 x 12= 5,01,864

The principal amount repaid is Rs. 50,00,000

The total interest repaid over the lifetime of the loan is Rs. 50,37,281

And the total amount repaid (including interest and principal) is Rs. 5,01,864 x 20=Rs. 1,00,37, 281

For self-occupied properties, the maximum interest deduction limit is Rs. 2 lakhs per year.

The maximum deduction limit under Section 80C is Rs. 1.5 lakhs per year.

Assuming a tax rate of 30%, we can use the formula:

Tax Saved = (Yearly Interest Deduction x Tax Rate) + (Yearly Principal Deduction x Tax Rate)

Tax Rate = 0.30 (30%)

In the beginning, the interest component in the EMI is more than the principal payment leading to tax savings as follows:

(below you can find the EMI calculator screenshots which have been used to calculate the interest and principal payments. The objective of the article: to showcase the tax saved from the interest and principal payments has been adhered to by the calculations mentioned. )

(The screenshots attached are only for clarification purposes, it must not be taken as a part of the article and it should be deleted after it.)

Year 1: (2,00,000x .3)+ (1,05,677x.3) = 91,703

Year 2: (2,00,000 x .3) + (1,14,449x .3)= 94,335

Year 3: (2,00,000 x .3) + (123,949 x .3) = 97,185

Year 4: (2,00,000 x .3) + (1,34,237 x .3) = 1,00,271

Year 5: (200,000 x .3) + (145,380 x .3) = 1,03,614

After year 5, the interest and the principal components both exceed the deduction limits, leading to tax savings as follows:

Year 6: (200,000x .3) + (150,000 x .3) = 1,05,000

Year 7: (200,000x .3) + (150,000 x .3) = 1,05,000

Year 8: (200,000x .3) + (150,000 x .3) = 1,05,000

Year 9: (200,000x .3) + (150,000 x .3) = 1,05,000

Year 10: (200,000x .3) + (150,000 x .3) = 1,05,000

Year 11: (200,000x .3) + (150,000 x .3) = 1,05,000

Year 12: (200,000x .3) + (150,000 x .3) = 1,05,000

Year 13: (200,000x .3) + (150,000 x .3) = 1,05,000

Year 14: (200,000x .3) + (150,000 x .3) = 1,05,000

From the 15th year, the interest component falls below the deduction limit and the principal component stays above the deduction limit, leading to tax savings as follows:

Year 15: (179,155x .3) + (150,000 x .3) = 98,747

Year 16: (152,373x .3) + (150,000 x .3) = 90,712

Year 17: (123,366x .3) + (150,000 x .3) = 82,010

Year 18: (91,948x .3) + (150,000 x .3) = 72,584

Year 19: (57,928x .3) + (150,000 x .3) = 62,378

Year 20: (21,081x .3) + (150,000 x .3) = 51,324

The total tax saved on the principal and interest component throughout the loan tenure adds up to Rs.18,89,863.

Home Loan Tax Benefits Under Section 24 & Section 80C

When it comes to tax rebates on home loans, understanding the different sections of the income tax law is essential. Section 24(b) for interest deduction and Section 80C for principal repayment deduction are two important sections for a tax deduction.

By exploring the eligibility criteria, maximum limits, and conditions associated with each section, you will gain a comprehensive understanding of the tax benefits available to homeowners.

Section 24(b) – Interest Deduction:

Under Section 24(b) of the Income Tax Act, homeowners can claim tax deductions on the interest paid toward their home loan.

Eligibility Criteria

To be eligible for this deduction, the home loan should be taken for the purpose of purchase, construction, renovation, or repair of a residential property. The property should be self-occupied, let out, or deemed to be let out.

Maximum Limit

For self-occupied properties, the maximum deduction limit is set at Rs. 2 lakhs per year. However, if the property is not self-occupied, the entire interest paid can be claimed as a deduction, without any maximum limit.

Conditions

To claim this deduction, the construction of the property should be completed within five years from the end of the financial year in which the loan was taken. Additionally, the loan must be taken from a recognized financial institution, including banks, housing finance companies, or certain notified entities.

Section 80C – Principal Repayment Deduction

Under Section 80C of the Income Tax Act, homeowners can avail of tax deductions on the principal repayment of their home loan.

Eligibility Criteria

To claim this deduction, the home loan should be taken for the purpose of the purchase or construction of a residential property.

Maximum Limit

The maximum deduction limit under Section 80C is Rs. 1.5 lakhs per year. However, note that this deduction is part of the overall limit under Section 80C, which includes other eligible investments and expenses.

Conditions

To claim this deduction, the property should not be sold within five years from the end of the financial year in which the possession was obtained. Additionally, the loan must be taken from specified financial institutions, including banks, housing finance companies, or certain notified entities.

Final Thoughts on Home Loan Tax Benefits

Understanding the home loan tax benefits for 2023 is essential for homeowners who want to optimize their tax savings and financial well-being. By familiarizing yourself with the calculation process, the relevant tax sections, and the eligibility criteria, you can make informed decisions that lead to significant savings.

Calculating tax benefits involves considering factors like the loan amount, interest rate, and repayment tenure. By following a step-by-step guide, you can determine the interest component and plan your tax deductions accordingly.

The income tax law provides tax rebates on home loans through sections like 24(b) and 80C. Understanding the eligibility criteria, maximum limits, and conditions associated with each section is crucial for maximizing your tax benefits. Section 24(b) allows for deductions on the interest paid, while Section 80C provides deductions on the principal repayment.

Sign up with Koshex to navigate the complexities of home loan tax benefits and receive personalized guidance. Don’t miss out on the opportunity to save big on your taxes and secure a brighter financial future.

Frequently Asked Questions (FAQs)

Q1. Are there any restrictions on the type of property for which I can claim tax benefits?

Ans. To claim tax benefits on your home loan, the property should be a residential property. It can be self-occupied, let out, or deemed to be let out. However, properties used for commercial purposes or purely for investment purposes are not eligible for tax deductions.

Q2. What documents do I need to maintain to substantiate my home loan tax benefit claims?

Ans. Proper documentation is crucial when claiming home loan tax benefits. It is important to maintain records of loan statements, interest certificates, and other relevant documents. These documents will serve as evidence of the loan amount, interest paid, and principal repayment, and will help substantiate your claims during tax assessments.

Leave a Comment