Smart Ways to Save Money with Health Insurance

Healthcare costs are on the rise. Today, most families are just one medical bill away from creating financial havoc in their lives. In such cases, having health insurance is not just a smart move but a necessity. While health insurance policy provides a financial safety net in times of illness, the costs associated with it can sometimes be a concern.

The Covid-19 pandemic saw a significant rise in insurance costs. However, several smart strategies exist to save money and make the most of your health insurance. Let’s explore different ways to save money while ensuring you have the necessary coverage. Sign up with Koshex to stay on top of your finances.

What Does Health Insurance Cost?

Before understanding how to save on health insurance costs, you need to understand what health insurance actually costs. Health insurance costs include various components such as premiums, copayments, deductibles, and out-of-pocket expenses.

Insurance premiums are the regular payments you make for your insurance coverage. Copayments are the fixed amounts that you will bear despite having a health insurance policy. It is usually 10%-20% of the medical expenses and varies across different policies and insurance service providers. For instance, suppose you lodge a claim of Rs. 1,00,000, and your insurance policy has a 10% copayment condition. Therefore, you will have to bear Rs. 10,000 while Rs. 90,000 will be borne by the insurance company.

Deductibles are the amount you pay before your insurance coverage kicks in. For instance, suppose deductibles in your insurance policy are set at Rs. 15,000. Therefore, your insurance provider will contribute only after you have paid Rs. 15,000 for expenses.

Managing these costs wisely can lead to significant savings on your insurance costs.

Also read: How To Renew Health Insurance Policy?

Ways to Save on Health Insurance

Here are some of the effective ways to save on your medical care health insurance costs:

1) Buy Insurance at a Young Age

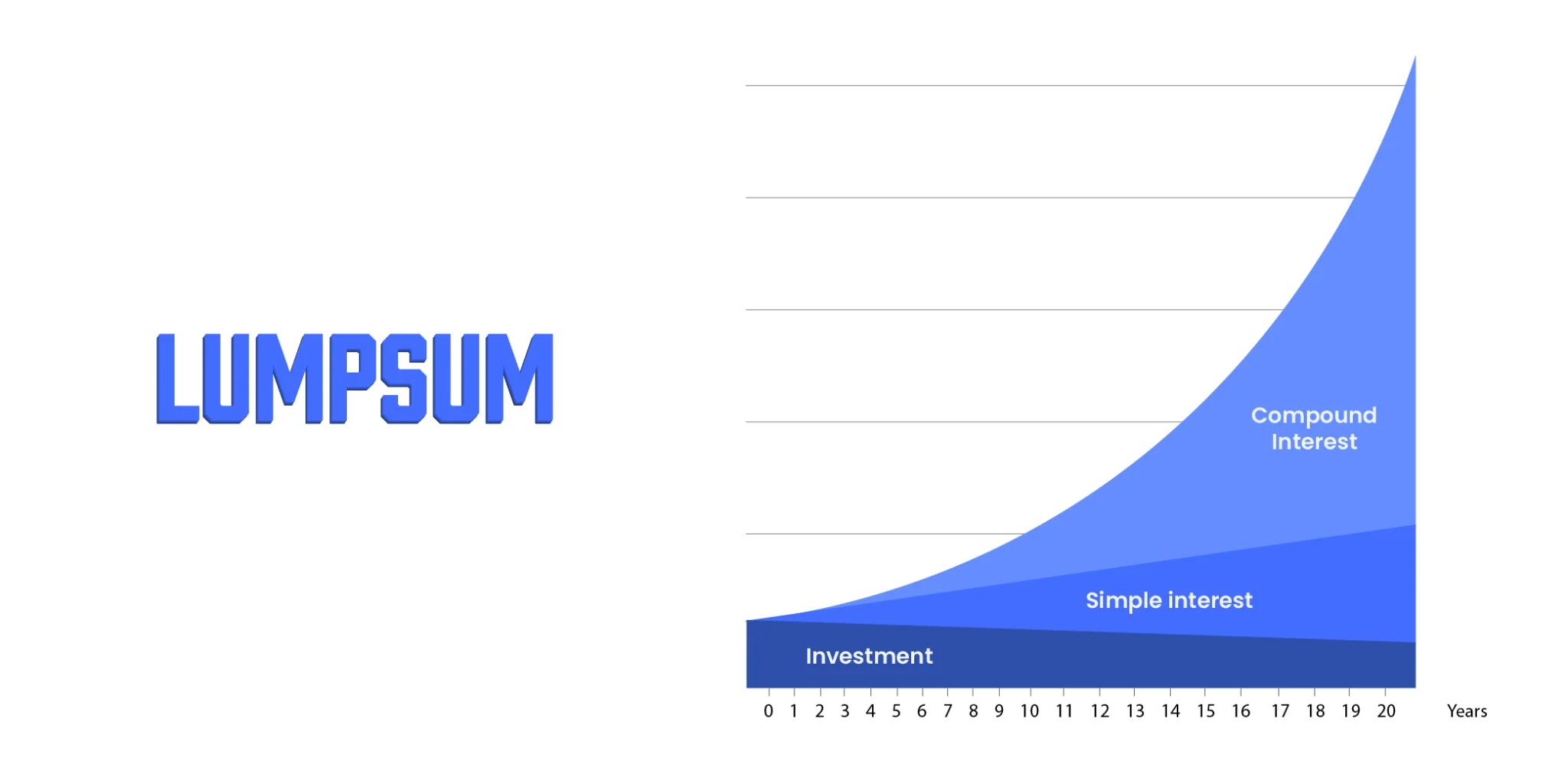

One of the most innovative ways to save on health insurance is to buy it at a young age. At a lower age, the risks associated with getting affected by lifestyle or chronic diseases are quite low. Hence, insurance premiums are generally lower for younger individuals. Buying insurance early at a lower premium can lead to substantial savings in the long term.

2) Live a Healthy Life

A healthier lifestyle can directly impact your health insurance costs. Insurance companies often reward healthy habits with lower premiums, and the reason is quite simple. It reduces the risk to insurance companies. Regular exercise, a balanced diet, and routine health check-ups contribute to your well-being and also help reduce your insurance expenses.

3) Give up on Bad Habits

Smoking and excessive alcohol consumption are detrimental to your health and can significantly increase your healthcare insurance premiums. These habits make you prone to some of the most chronic and life-threatening diseases. Quitting these habits improves your overall health and can lead to substantial savings on insurance costs.

Also Read: Should You Consider FDs With Health Insurance Benefits?

4) Buy a Family Floater Plan

You should consider opting for a family floater health insurance plan instead of individual policies if you are planning to cover your entire family with health insurance. Family floater plans cover the entire family under a single health insurance policy, and the insurance coverage amount is available for all the family members. They are cost-effective and provide higher insurance coverage than individual policies.

5) Enjoy No Claim Bonus

Many health insurance policies offer a no-claim bonus. This means if you don’t make any claims during a policy year, your insurer provides you a no-claim bonus in the form of increased coverage or a reduction in premiums. This also encourages you to maintain a healthy lifestyle and minimizes unnecessary claims.

6) Claim Tax Deductions

Paying health insurance premiums can qualify you for tax deductions. This helps you save money and encourages responsible financial planning. You can claim a deduction for health insurance premiums under section 80D. The deduction amount is up to Rs. 25,000 for you and your family. You can also claim a separate deduction of Rs. 25,000 for health insurance premiums paid for your parents. Further, if any person is a senior citizen, i.e., above the age of 60, then the limit increases to Rs. 50,000.

7) Go for Cashless Claims

You should opt for medical care health insurance plans that offer cashless claims. With cashless claims, you don’t need to pay the hospital bills out of pocket and then seek reimbursement. Cashless payment can eliminate the condition of copayment. Apart from providing convenience, it also helps in better financial planning. However, you should always check for the network hospitals where you can benefit from a cashless facility.

Also Read: The Difference Between Life Insurance And Health Insurance

Summing Up

Health insurance is an essential and one of the most critical aspects of financial planning. Finding ways to save on its costs is a wise move. By adopting a healthy lifestyle, making informed choices when purchasing insurance, and following the rest of the above tips, you can ensure that you are covered in times of need and are also saving money in the process. However, in any case, building and maintaining a financially stable lifestyle is key to any of your financial goals.

Koshex is a preferred investing platform for today’s investors who wish to build and generate wealth to lead a better financial future. You can invest in different avenues like mutual funds, digital gold, smart deposits, and fixed deposits. While you save on your insurance costs, investing and building to generate wealth is essential. Sign up with Koshex now!

Frequently Asked Questions

Q: Can I switch my health insurance policy to save money?

A: Yes. You can switch your health insurance policy or even the insurance provider to find better coverage or lower your insurance premiums. But, it’s essential to carefully compare policies and ensure no coverage gap during the transition.

Q: How does a family floater plan work?

A: A family floater plan covers the entire family under a single policy. Any family member can utilize the sum assured in case of a medical emergency. The sum assured used by any member reduces the total limit available. Family floater plans are often more cost-effective than individual policies for each family member.

Q: What is a no-claim bonus in health insurance?

A: A no-claim bonus is a reward the insurance companies offer to policyholders who do not make any claims during the year. This bonus can come in the form of an increase in coverage, reduction in premiums, or other benefits, depending on the insurance provider.

Q: What are cashless claims in health insurance?

A: In cashless claims, you can avail of medical services at network hospitals without paying for medical treatment upfront. The insurance company directly settles the bills with the hospital. This eliminates the need to pay the medical bills and claim reimbursement from the insurance company, thus saving your cash outflow.

Leave a Comment