The 15*15*15 rule in mutual funds suggests a guideline where investors are advised to stay invested for at least 15 years, invest at least 15% of their income, and review their investments every 15 months for better returns.

If you are an investor, who is looking to accumulate a significant amount of corpus in the future, you should definitely know about this rule.

This is an important rule in mutual funds and it can help guide you and even motivate you to stay invested for the long term to reap the benefits of compounding. In this article, we will talk about what this rule is, how it works, and how you can make it work in your favor.

Becoming a crorepati is a dream of many. Who wouldn’t want to have one crore in their bank account to do whatever they want with that money? It is a dream come true after all! With mutual funds, you can turn that dream into a reality.

How you wonder? Here’s where the 15*15*15 rule comes into play.

What Is The 15*15*15 Rule?

According to the rule, if you invest ₹15,000 per month for 15 years in a fund scheme that offers a 15% interest annually, you can accumulate ₹1 crore at the end of the tenure. In order to make this investment, you would only require ₹27 lakhs while you will earn over ₹73 lakhs. If you stay invested for another 15 years, your corpus will grow to ₹10 crores, and so on.

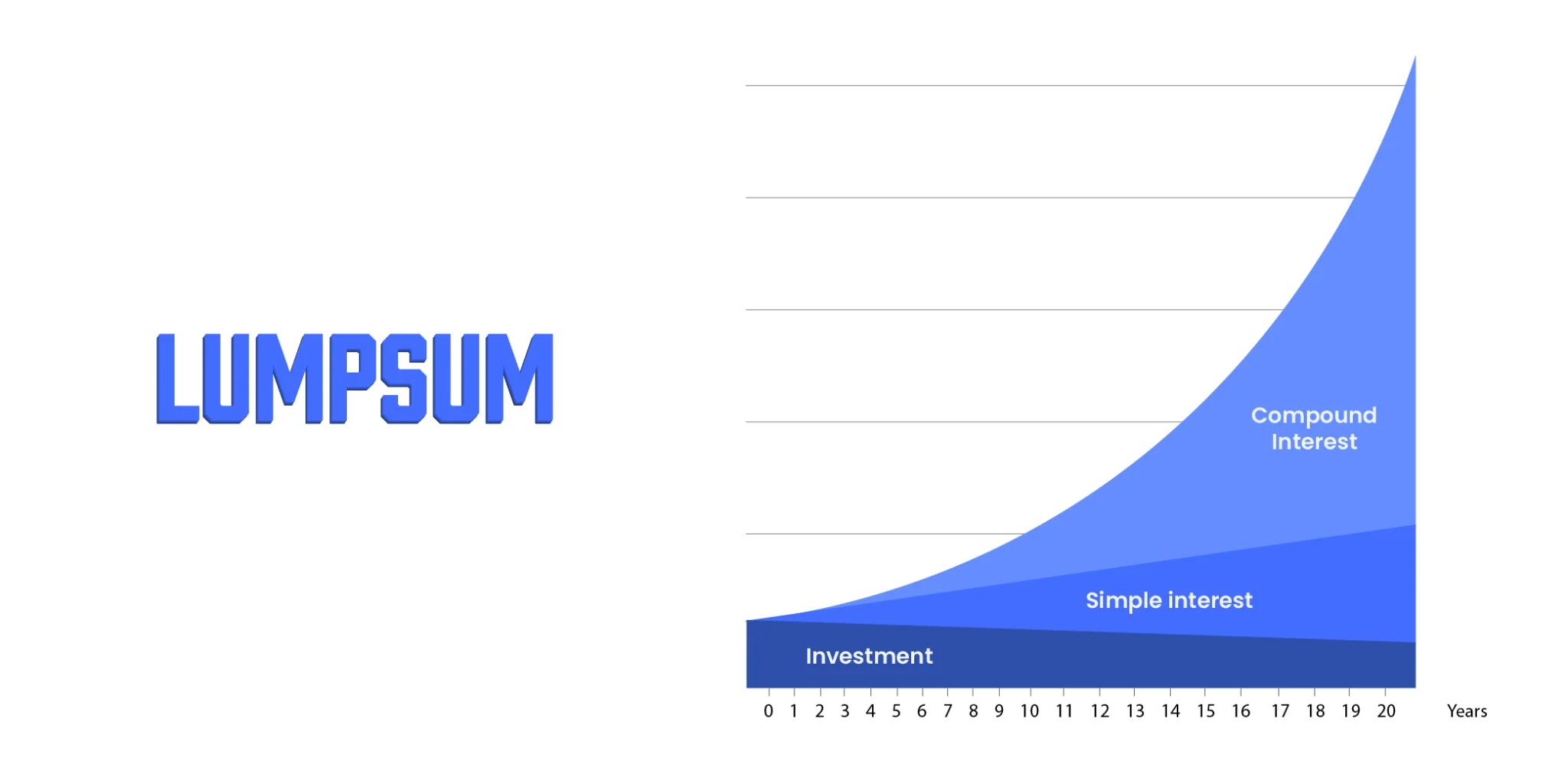

How does this work? Meet the power of compounding. Compounding is what helps your money grow at an accelerated rate and build a significant corpus.

What Is Compounding?

Compounding means your money is earning interest by reinvesting the interest earned. As mentioned above, the magic of compounding can turn a small amount invested regularly into a very large corpus. For example, you deposited ₹10,000 in a savings account that accrues 10% interest annually. After one year, you would have ₹11,000 in your account. After two years, your interest would have compounded, and you would have ₹12,100.

This is because you are not just earning 10% interest on your initial deposit (₹10,000), you are also earning interest based on your new total earnings (₹11,000). Hence, after two years, you will earn your 10% interest based on your new total of ₹11,000. Here’s a table explaining the entire process.

| 1st-year | 2nd-year | 3rd-year | |

| Starting Balance | ₹10,000 | ₹11,000 | ₹12,100 |

| Adding the 10% interest | ₹1000 | ₹1,100 | ₹1,210 |

| Total Balance | ₹11,000 | ₹12,100 | ₹13,310 |

Here’s the formula to calculate the compound interest, if you wish to know the technical process.

FV= PV *(1+i)n

FV = Future Value

PV = Present Value

I = Rate Of Interest

n = Compounding Periods

The calculation of the above example will look like this.

Beginning amount – ₹10,000

1st-year – ₹10,000 + (100 x 10%) = ₹11,000

2nd-year – ₹11,000 + (110 x 10%) = ₹12,100

3rd-year – ₹12,100 + (121 x 10%) = ₹13,300

After 10 years, your ₹10,000 deposit would grow to ₹25,937. That’s the power of compounding.

What Are The Benefits Of The 15*15*15 Rule?

There are several benefits to this rule. Here is a list of advantages you will get when you follow this rule.

Regular Habit

When you follow the 15*15*15 rule, you need to be consistent and have the discipline for your investment to work. The rule brings this aspect via a Systematic Investment Plan (SIP) so that you can easily manage your investments. SIPs have automated payment options, so once you have set up your automatic payments, your SIPs will be deducted every month without any hassle.

Compounding Effect Of 15*15*15 Rule

As we have mentioned before, the magic of compounding is a major benefit when you follow the 15*15*15 rule. Here’s an example of how compounding can help you if you stay invested for the long term.

| Mr. A | Mr. B | |

| Age When They Started Investing | 25 | 30 |

| Age When They Exited Their Investments | 60 | 60 |

| Years they were investing money | 10 years | 30 years |

| Years they were holding the investment | 35 years | 30 years |

| Amount invested every month | ₹5000 | ₹5000 |

| Total Amount Invested | ₹6,05,000 | ₹18,05,000 |

| Total returns earned | 10% per year | 10% per year |

| Total wealth earned | ₹1,26,00,000 | ₹1,15,00,000 |

In the above example, you can see that Mr.A only invests for 10 years but ends up accumulating more wealth than Mr.B, who invested for 30 years. The power of compounding can turn your investment into a huge corpus as shown in the example above.

Flexibility

When you invest in mutual funds via SIP, you can pause, stop, or skip payments as required. This flexibility helps during times of emergency when you can’t make the SIP payments. You can also redeem your investments whenever you want since most mutual funds do not have lock-in periods. Unlike traditional investment instruments like Fixed Deposits, PPF, or insurance policies, your money is tied up and free to be redeemed whenever you wish.

Rupee Cost Averaging

One of the biggest benefits one gets from investing in mutual funds via SIPs is rupee cost averaging. The rupee cost averaging strategy helps you to take advantage of the market highs and lows that will benefit your investment. Let’s understand this better with an example.

Let’s say that you start investing ₹10,000 every month and this investment would create units in the mutual fund based on the NAV (Net Asset Value). If the NAV is 25, then 400 units would be allotted (10,000/25=400).

The NAV is the reflection of the market movement on which the fund is based and it can go up or down based on how the market functions. If the stock market trades lower, you would be allocated more than 400 units and vice versa. However, the amount you pay (i.e. ₹10,000) will remain the same even if you are allocated over 400 units or less than 400 units per month.

| Month | NAV | SIP Amount | Units Allotted | Cumulative Units |

| January | 25.0 | 10,000 | 400 | 400 |

| February | 26.3 | 10,000 | 380 | 780 |

| March | 24.3 | 10,000 | 410 | 1,190 |

| April | 28.5 | 10,000 | 350 | 1,540 |

| May | 22.7 | 10,000 | 440 | 1,980 |

When you examine the example closely, you can see that the NAV is the highest in April (likely when the market was up) but the number of units allotted during that time is the lowest. However, when you look at the month of May, you can see that the NAV is the lowest (likely when the market was down) but the number of units that were allotted during that time was the highest.

The point to note here is that you are investing the same amount of ₹10,000 via SIP during all the months but the NAV changes and the number of units that are allotted to you changes as well. Over time, as your SIP progresses, you will have invested across all market phases. So, your average cost will be reasonable. This is called rupee cost averaging.

In The End…

The 15*15*15 rule has been followed by many investors for several years. We can say that it is relevant even in today’s day and age. It is obvious that if you follow this rule, you need to stay invested for the long term. So, for your short-term and medium-term goals, it is important to create portfolios that will help you achieve those goals.

Before you get tied up in investments that require you to stay invested for the long term, you need to create an emergency fund and also, plan for your taxes beforehand. This will help you during emergencies and be prepared for the tax season.

We hope you learned everything about the 15*15*15 rule, how it works, and how you can use it to accumulate a huge corpus. If you wish to start investing in mutual funds via SIP, create a free account with Koshex today and start your journey to becoming a crorepati. You can create an account with us in less than 60 seconds and we have 5000+ mutual funds for you to choose from. So, there is a mutual fund for every type of goal you want to achieve. Head over to our website and get started today!

Knowledge Korner – If you wish to learn more about personal finance and investing, head over to our website and check out our Blogs. You can learn everything from budgeting your salary to saving income tax in our blog section. See ya there!

Leave a Comment